India's domestic scrap consumption strengthens in CY'25 as collection efficiency improves

...

- Crude steel production rises 10%, demand up 8% on-year

- Price viability lures buyers to domestic scrap

- Sponge iron gives scrap strong competition

India's steel industry in CY'25 saw a significant surge in production, with crude steel output rising 10% y-o-y to 164 mnt, up from 149 mnt in 2024, according to BigMint data. The total increase of around 15 mnt was driven by growth across both the BF-BOF and EAF-IF routes, with private and public sector mills contributing to the expansion. This marks a clear acceleration compared to the more modest 6% growth in 2024, which had been constrained by a pre-General Election slowdown and a surge in imported cost-competitive steel.

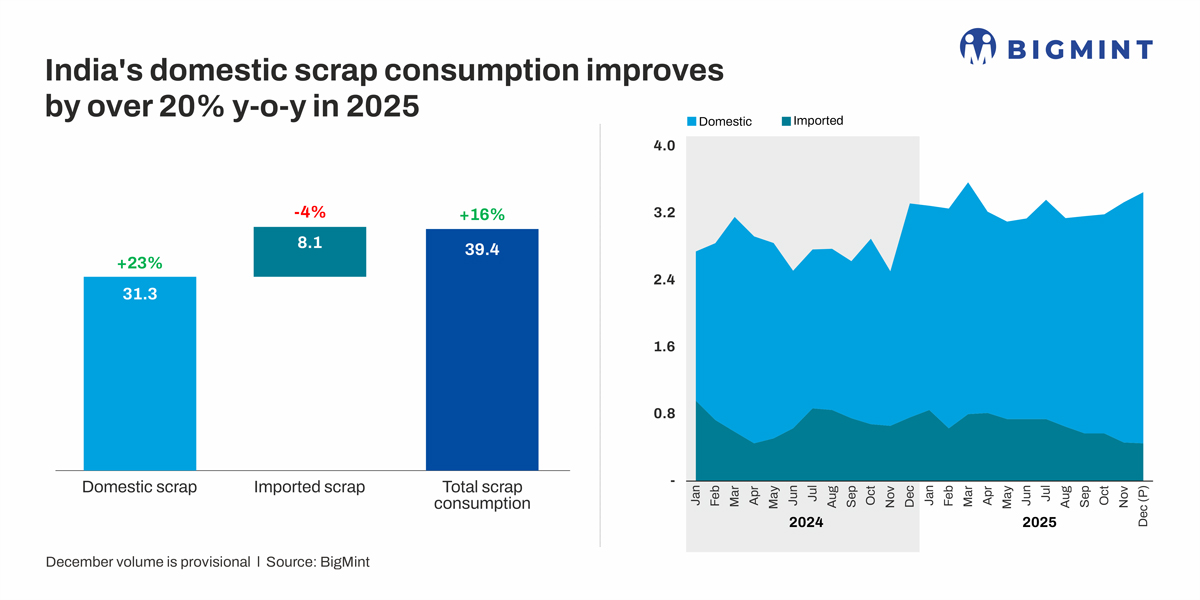

Against this backdrop, domestic ferrous scrap consumption in CY'25 exhibited structural strength, reflecting deeper improvements in the underlying demand fundamentals rather than a short-term recovery. Strong collection and processing efficiencies, along with higher scrap availability, drove robust year-on-year growth, consistently in the mid-teens, and accelerating further in the second half of the year.

The trend also signals a gradual moderation in import dependence, as domestic scrap increasingly filled the incremental demand. The combination of higher domestic supply, cost competitiveness relative to imported scrap, and supportive demand from induction furnace and electric furnace-based steel production contributed to a healthier consumption profile, underlining domestic scrap as a key growth driver in CY'25.

Overall, the CY'25 sentiment points to a resilient ferrous scrap market, where structural demand growth, domestic-led supply, and stable pricing dynamics collectively set a positive tone for the year ahead.

Price competitiveness

Domestic scrap remains cheaper than imported in CY'25

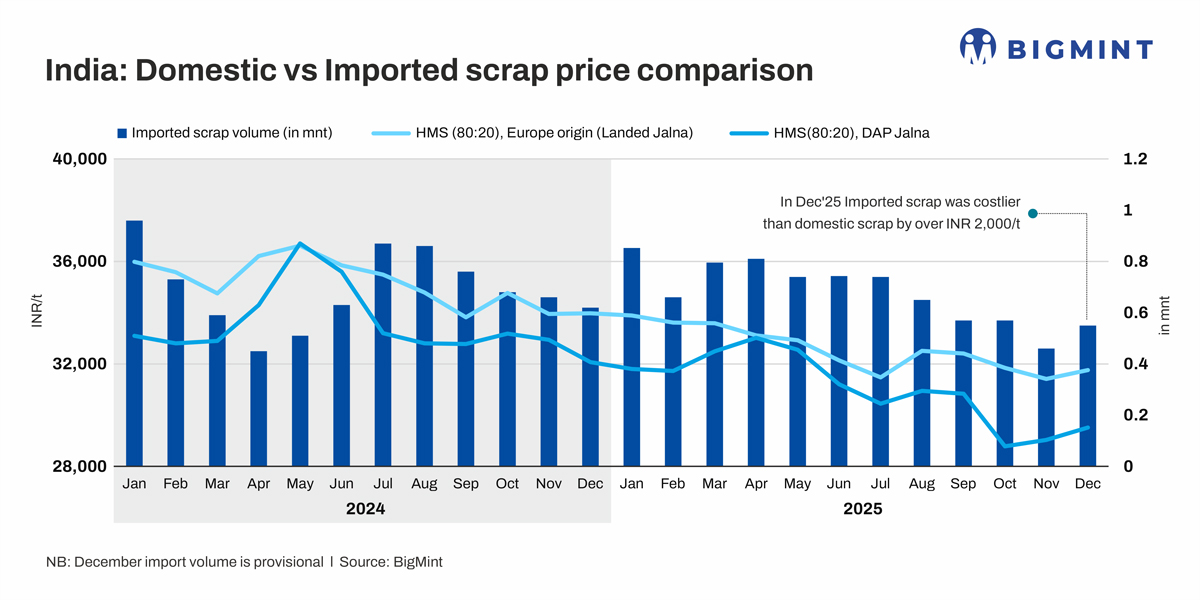

India's ferrous scrap market in CY'25 continued to show strong domestic preference, as local scrap remained consistently more cost-competitive than imported material throughout the year.

Data from January to December 2025 indicate that HMS (80:20) scrap of European origin landed at Jalna was significantly costlier than domestic scrap (DAP Jalna), with the premium reaching over INR 2,000/t in December 2025. This price gap reinforced the attractiveness of domestic scrap for steel producers, especially in electric furnace-based steelmaking.

Both imported and domestic scrap prices show a gradual decline through 2025. While imported scrap prices softened, domestic scrap prices also decreased in tandem, though domestic scrap remained consistently cheaper than imports. The narrowing price gap, coupled with falling import volumes, indicates that mills continue to favor domestic scrap sources despite the overall price drop.

Overall, the trend underscores a structurally stronger domestic scrap market, where local supply increasingly meets incremental demand, controls cost pressures and reduces import dependence.

Sponge iron gives stiff competition to ferrous scrap

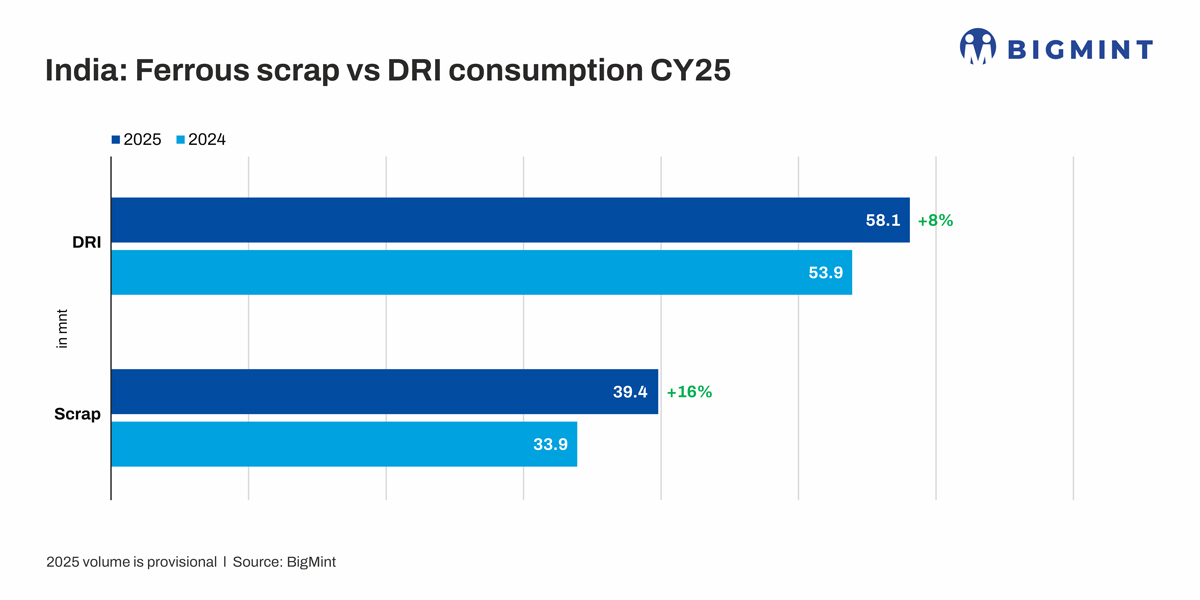

India's ferrous scrap consumption recorded a strong rise in CY'25, increasing by 16% year-on-year to 39.4 million tonnes (mnt) from 33.9 mnt in CY'24, reflecting higher domestic scrap usage amid growing steel production. The sharper growth rate highlights increasing acceptance of scrap as a key raw material, supported by improved collection and processing within the country.

However, sponge iron (DRI) continued to maintain its dominance in the steelmaking mix. DRI consumption also rose, albeit at a slower pace of 8%, reaching 58.1 mnt in CY'25 compared with 53.9 mnt in the previous year. The parallel growth of both inputs indicates that while scrap is gaining traction, DRI remains a strong competitor, ensuring balanced raw material usage and limiting any sharp shift toward scrap-only steelmaking in India.

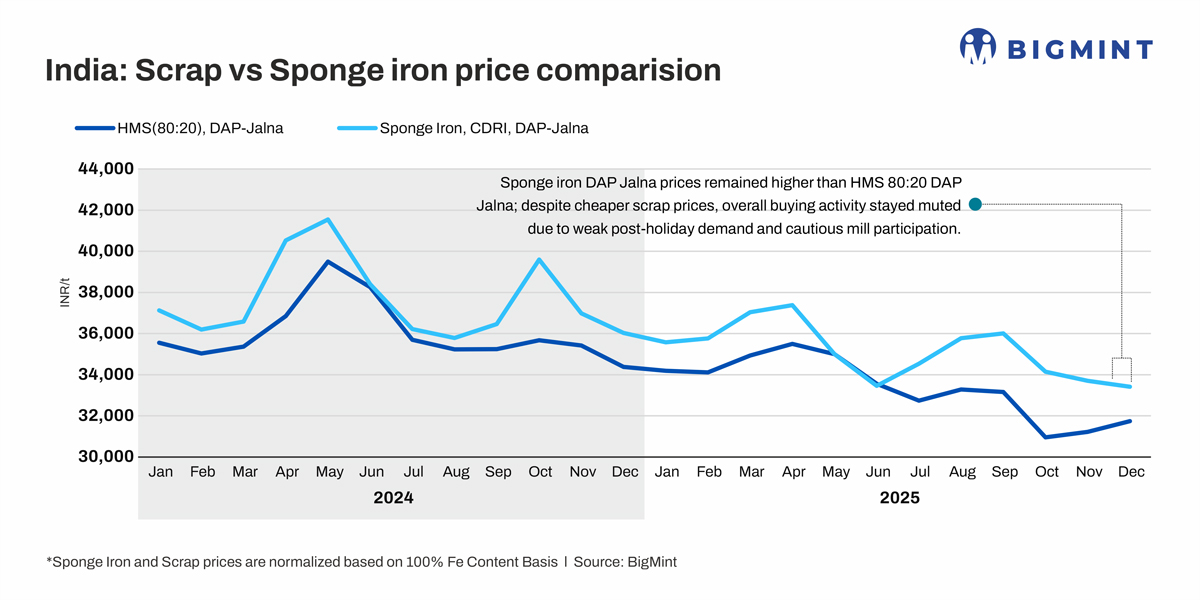

Sponge iron continues to cap scrap price upside

The sponge iron-scrap price comparison highlights the persistent cost competition between the two raw materials throughout CY'25. While domestic scrap availability improved and prices softened during the year, sponge iron continued to track closely, often capping any sharp upside in scrap prices. This parallel movement indicates that steelmakers retained operational flexibility, switching between scrap and DRI based on relative price advantages and furnace economics. Overall, the comparison reinforces that although scrap consumption strengthened structurally, sponge iron remained a strong substitute, ensuring balanced raw material usage and limiting excessive volatility in the ferrous input market.

Outlook:

Going into CY'26, India's ferrous scrap market is expected to remain structurally strong, supported by steady steel production growth, improving domestic collection efficiency, and continued preference for local scrap over imports. However, upside in scrap prices is likely to stay capped by sustained availability of sponge iron and mills' ability to switch between raw materials based on relative cost economics. While demand fundamentals remain healthy, price movements are expected to stay range-bound, with volatility driven largely by steel margins, seasonal supply flows, and policy developments rather than supply tightness.