India: Chennai's ferrous scrap prices drop INR 100/t w-o-w on muted steel demand - 9 Jan

...

- Mills opt for maintenance shutdowns as Pongal nears

- Liquidity crunch contributes to slower trade activity

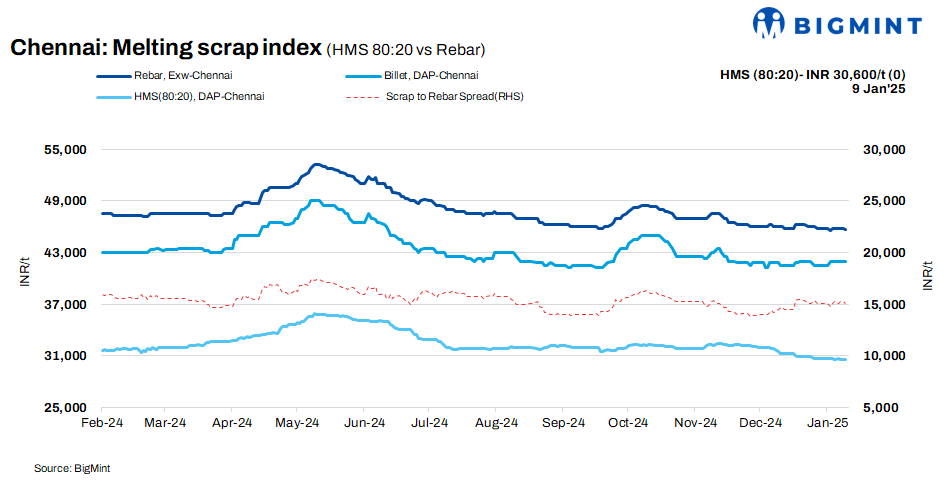

Prices of HMS (80:20) decreased by INR 100/t w-o-w to INR 30,600/t in Chennai, India, according to BigMint's latest assessment. However, prices remained stable d-o-d. While billet prices remained stable at INR 42,000/t on w-o-w and d-o-d bases, rebar prices saw a small d-o-d decline of INR 100/t to INR 45,700/t. However, rebar tags increased by INR 200/t on a w-o-w basis.

Market activity remained cautious, with trade volumes at an average level, and steel demand is subdued due to the approaching Pongal festival.

Imported, domestic market trends

According to a scrap trader, shredded offers from Australia were at approximately $375-380/t CFR Chennai, while offers for EU-origin material stood at around $380/t. Meanwhile, HMS (80:20) offers were at around $355-360/t for Australian-origin material. However, buyers were reluctant to purchase at these prices, amid expectations of further declines.

HMS (80:20) scrap prices in the domestic market were quoted at INR 30,500-31,000/t for buyers paying within seven days. For extended payment terms, prices were higher, at INR 31,000-31,500/t. Most offers remained within the INR 30,500-31,000/t band, and a significant share of deals closed at these rates.

Buyer-supplier sentiments

According to a mill representative, finished steel demand continued to be low, with buyers refraining from bulk purchases and opting for need-based procurement instead. The approaching Pongal festival is expected to further reduce market activity, as many participants will be on holiday, which is likely to impact trade dynamics in the coming days.

A scrap supplier stated that HMS (80:20) scrap prices were at INR 30,500-31,500/t, based on payment terms. The market has been experiencing a liquidity crunch, contributing to slower trade activity in recent weeks. Additionally, the upcoming Pongal festival has led some mills to opt for maintenance shutdowns. Furthermore, IT raids conducted at Chennai-based mills have raised additional concerns within the market.

Regional comparison

Billet prices in the western India-based Jalna market dropped by INR 200/t d-o-d to INR 41,300/t, while rebar tags saw a d-o-d decline of INR 500/t to INR 46,000/t. However, HMS (80:20) scrap prices held steady d-o-d at INR 31,900/t. Overall trade activity for finished steel was at an average level, with moderate scrap supply being indicated by mills.

Outlook

Amid the ongoing market slowdown, scrap prices are expected to move within a relatively narrow range in the near term, with potential fluctuations of INR +/- 500/t.