How did India's metallic mix shift amid increased crude steel production in Apr-Oct'24? - BigMint analysis

...

- DRI consumption up 10% y-o-y in 7MFY'25

- Domestic scrap share rises, imports edge down

- Share of hot metal may rise 8% y-o-y in FY'25

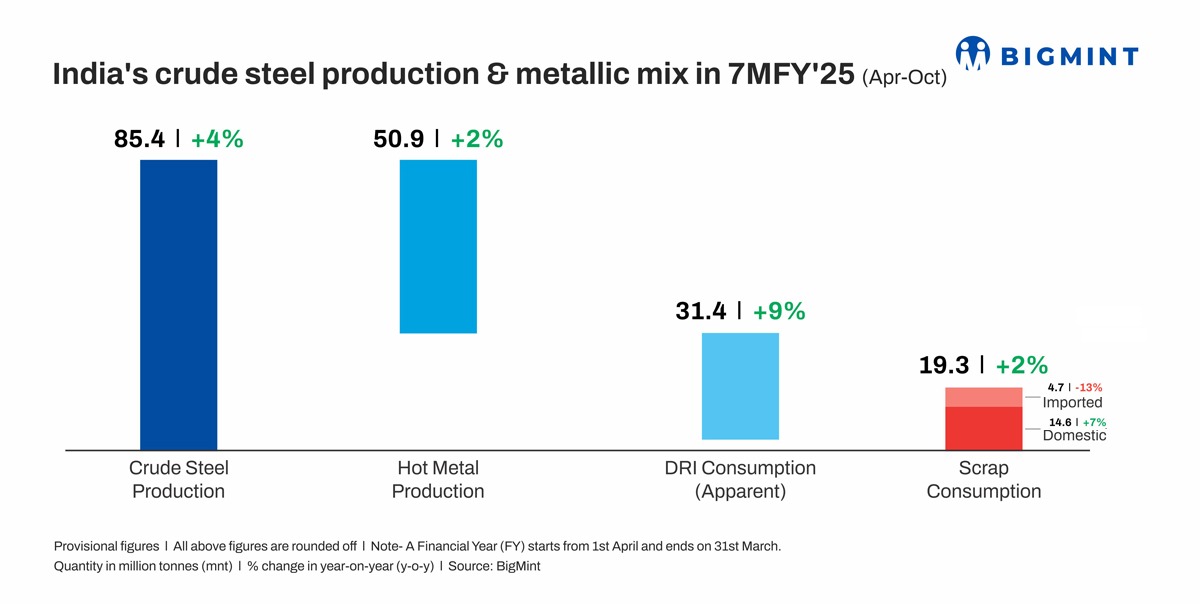

Morning Brief: India's production of crude steel increased by close to 4% y-o-y in April-October 2024 (7MFY'25) to over 85 million tonnes (mnt), as per provisional data available with BigMint. However, the respective shares of metallics in crude steel production witnessed subtle changes.

The changes are mainly attributable to the sharp rise in consumption of DRI by the EIF-EAF-based domestic steel producers, largely due to higher domestic availability amid capacity expansion in the sponge iron sector.

However, it should be noted that scrap consumption also witnessed an increase, y-o-y, although the surge might have been higher but for increased DRI usage, as well as constraints in imported scrap availability.

Metallic mix - highlights

*Hot metal production is expected to have increased by 2% y-o-y to around 51 mnt during the period under review. BF-based iron-making capacity expansion is expected to propel India's phenomenal capacity growth in the steel sector in the years to come.

*DRI consumption (apparent) reflects an increase of nearly 10% y-o-y in 7MFY'25. Capacity expansion in the sector has happened at breakneck pace, with countrywide capacity currently pegged at around 63 mnt. Fast-paced capacity addition, easier availability compared with scrap, and cost priorities favoured DRI.

BigMint's benchmark iron ore prices in Odisha decreased by 5% y-o-y in 7MFY'25, while pellet prices were largely stable. As a result, pellet-based sponge iron prices in Raipur, a key market, witnessed a decline of 7% y-o-y during the period under investigation. Coal prices, too, were on the lower side due to higher domestic production. Therefore, cost factors contributed to increased DRI usage. DRI production is supposed to have edged up by around 8% y-o-y to over 31 mnt.

*Scrap consumption is likely to have increased by around 2% y-o-y in 7MFY'25 on higher crude steel production from the EAI-EAF route, as well as increase in overall steel production. Scrap usage by EAFs and IFs rose 11% y-o-y to 23 mnt in 10MCY'24, as per BigMint data. Policy interventions, such as the ELV recycling policy, have given a boost to domestic scrap generation and consumption, with the latter increasing by over 7% y-o-y in 7MFY'25.

However, imported scrap consumption declined sharply due to lower availability amid protectionist trade policies adopted by many countries to conserve this vital steelmaking ingredient for domestic use amid heightened concerns related to carbon emissions from steel production.

Outlook

As per BigMint estimates, India's crude steel production is expected to rise to around 152 mnt in FY'25, with hot metal production touching around 94 mnt, an expected rise of 8% y-o-y.

Consumption of DRI may touch 54 mnt, up from over 50 mnt in FY'24, while scrap usage may remain largely constant y-o-y at 33 mnt, despite higher crude steel production, due to DRI eating into scrap's share in the country's metallic mix.

Notably, pellet demand is also projected to increase by 10-15 mnt in FY'25 due to higher uptake by the BF-BOF steel producers, but mainly by the domestic DRI sector.