Green Steel Taxonomy: India takes significant strides towards cleaner steel industry

...

- Calculation relies on carbon credit trading methodology under both systems

- Finished steel is denominator in star ratings, crude steel for carbon credit trading

The Ministry of Steel, Government of India, recently unveiled the Taxonomy of Green Steel which is reportedly the first of its kind in the world, where steel produced in the country must conform to certain standards to be classified as environment-friendly.

Its relevance is immense in today's world since it will help the Indian steel industry, famously one of the heavy polluters, to transition to a more sustainable and low-carbon environment.

BigMint, along with Sentra.world jointly hosted a webinar recently on "Mastering Green Steel Taxonomy and CCTS" to decode the various aspects of the green steel taxonomy for a better understanding for industry stakeholders.

Key takeaways from the webinar:

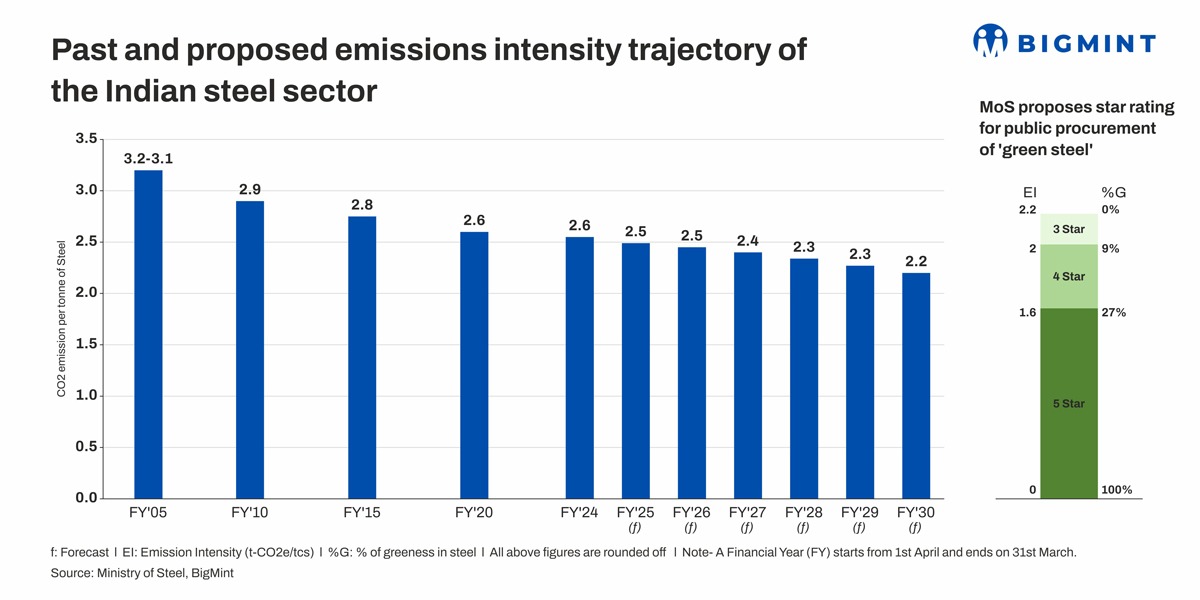

- India is the first country which has actually put a number to green steel with the launch of 2 key policies or systems. The first is the green steel star rating which got launched about a month ago. The second is CCTS (carbon credit trading scheme).

- The first layer (CCTS methodology) is one of calculation. Under both systems, the calculation relies on the CCTS methodology of carbon accounting which has been developed under the Bureau of Energy Efficiency with inputs from many organizations. It takes information and inspiration from many systems of calculation, but is attuned to India's needs.

- There is a small difference between the star rating methodology and CCTS. In star rating, finished steel is the denominator while in CCTS, it is crude steel.

- The reporting layer is the second in star rating as well as in CCTS. In star rating, any steel company in the country can participate in this.

- Any steel manufacturing company can apply and get the 3, 4, and 5 stars depending on where they stand. In case their Co2 emissions are above 2.2, they will not receive any rating at all.

- On the other hand, CCTS is a follow-up to the perform achieve and trade (PAT) scheme. So star rating is broader. CCTS is more narrow in terms of its coverage.

- CCTS is mandatory for companies. If they are in the top 200, star rating is optional. It becomes a necessity if one want to participate in public procurement.

- The bottom layer is monetisation. Monetisation of CCTS is going to be via carbon credits.

- In relation to the star rating, the government launched the green public procurement policy. The Government currently buys about 25% or 25 million tonnes of steel produced in the country. The Government will incentivise those suppliers or producers, who actually have low emissions. The moment a manufacturer gets a good star rating, it becomes eligible for public procurement.

- There is no silver bullet to achieving green steel or low carbon emission steel but multiple pathways. These include operational efficiencies, energy efficiency, inclusion of Artificial Intelligence in digitalisation -- all these aspects will have impact on the unit consumption of raw material per tonne of steel. So, use less and produce more which will bring down the equivalent carbon intensity, and that will also reduce cost of production of steel. This is the first lever, and with incremental capex of 7-8%, mills can achieve a carbon intensity reduction of 10-15%.

- The second lever is deployment of renewable energy, where all integrated steel producers want to deploy this lever in order to reduce the carbon intensity on the BF route. This lever will be able to reduce the carbon intensity by 7-10%. In synthesis gas-based DRI making, where the electricity consumption is close to 2- 2.5 times higher than in the BF route, the reduction will be close to 20%.

- The third lever, over the medium to long term, is about the deployment of carbon capture utilization. Though in India, because of geographical constraints, we are not talking about storage yet.

- Over the medium to long term, blue hydrogen is going to play a transitory role and then ultimately converge into the ultimate goal of green hydrogen. Coal gasification, coupled with carbon capture, utilization, can play an important transitioning role.

- The current Co2 intensity of DRI production is in the range of 1.7 t of Co2/tonne of DRI. DRI units can decarbonize via five methods. 1) Continuing with energy efficiency that has a potential of 10-20% reduction. In case of waste heat recovery, then 5-10% more. 2) Yield optimisation via implementation of digital tools -- AI etc -- to get another 3-5% increase in yield, and hence reduction in Co2 emissions. 3) Renewable energy. DRI units are not large consumers of electricity, but 10% of those emissions are still related to electricity which can be killed completely by adoption of solar. 4) Alternative materials. Biochar, for instance. That 1.7 t of Co2 can be reduced by 25-30%. By the active use of biochar, it can replace about 40% within the DRI unit. Theoretically up to 100%. 5) Carbon capture, utilization and storage. But, it is still high cost right now.

- Rolling mills and induction furnaces, must increase their share of scrap, and renewable energy. The future will see a lot of diplomacy to secure scrap.

- We need to focus on beneficiation of iron ore and coal. Improve raw material quality being used in DRI or any other process to further reduce consumption of energy.

- CCTS is focused only on the units which are consuming 20,000 tonnes of oil equivalent energy.

- The star ratings will be applicable for all steel manufacturers.

- CCTS to be launched in April. Applicants need to submit their monitoring and verification plan. Post-that, submission of mill's calculations. Post-that, one will have to submit its 5 Year Activity Plan, and then on a year-to-year basis, revised calculations and the extent of reduction need to be submitted.

- By 2030, India will see 50-60 mnt of low carbon emission green steel demand from Europe. So there's a business case as well.

- TMT is the main product which is going to benefit from star ratings, followed by structural steel used in making bridges etc.

- NISST is working with BEE to finalise the modalities to be uploaded on its website. Companies can register by paying an amount fixed by the ministry. The main procedure to revolve around the calculation of emissions.

- Scope 1 includes emissions related to fuel burning on site -- diesel or coal burning, vehicles plying inside.

- Scope 2 is related to electricity - purchased from outside or the grid. Co2 intensity of 0-7 to be applied.

- Scope 3 is the part which needs explanation. Currently transportation of raw materials, etc, that is excluded, is not included in the calculation. Also, Scope 3 currently excludes embodied emissions. So if one is buying raw material, the emissions associated with producing that raw material currently are being excluded.