Global scrap consumption in steel production may rise 35-40% by 2030

...

- Scrap demand worldwide to increase to 828 mnt by 2030

- China to lead global scrap generation, consumption

- Decarbonisation drive, higher carbon prices to facilitate faster EAF adoption

Morning brief: With the decarbonisation wave sweeping the global steel industry, SteelMint estimates that the usage of ferrous scrap in steel production is slated to increase by 35-40% by 2030.

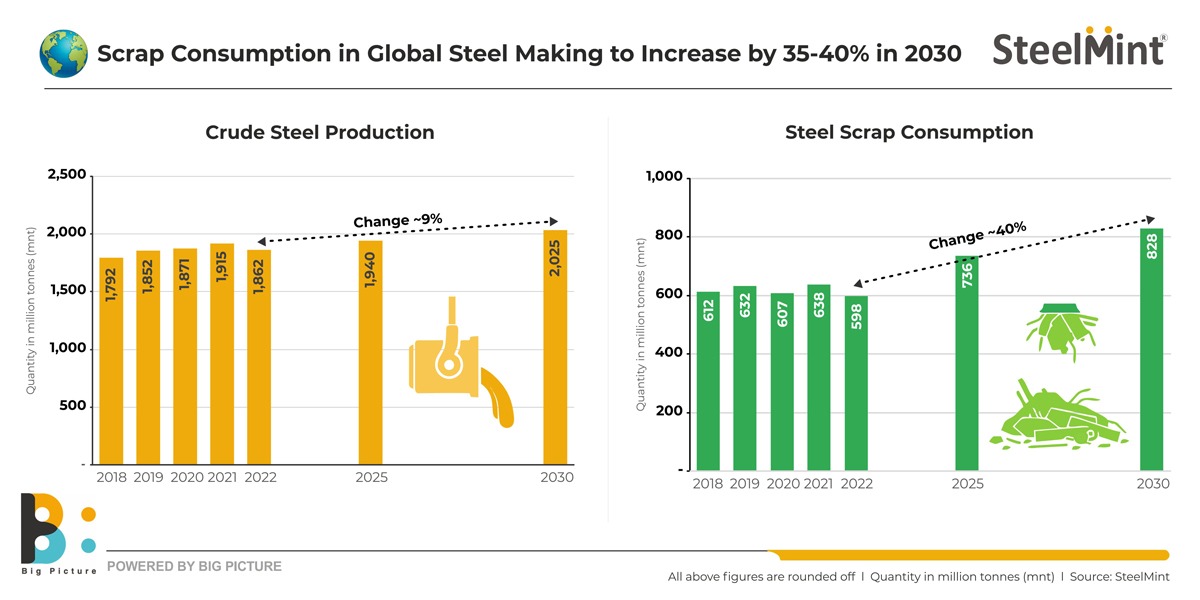

Data reveals that global steel production stood at over 1.8 billion tonnes (bnt) in 2022 and total ferrous scrap consumption in steelmaking was around 598 million tonnes (mnt), as per SteelMint data.

As China accounts for around 55% of global steel production, consumption of ferrous scrap in China was the highest at 225 mnt in 2020. However, the BF-BOF route still accounts for over 85% of steel production in China, as per WSA data. After China, the leading scrap consumers in steelmaking were the EU (78 mnt), the US (55 mnt), Turkiye (30 mnt), Japan (30 mnt), India (26 mnt), and South Korea (25 mnt).

As per SteelMint projections, global crude steel production is expected to edge up to 1.95 bnt by 2030 and scrap consumption in steelmaking is likely to increase to 828 mnt.

Factors driving scrap consumption

Decarbonisation drive: Ferrous scrap consumption will inevitably rise as the steel industry's efforts to reduce its environmental footprint gather stream. As per WSA, using scrap for production of 1 tonne of steel saves 1.4 t of iron ore, 740 kg of coal and 120 kg of limestone. With recycling and remanufacturing, essential pillars of the circular economy, gaining increasing currency, scrap usage is bound to increase. The emissions intensity of the BF-BOF route of steelmaking is around 1.9-2 tCO2/tcs (tonne of crude steel), while emissions from scrap-based EAFs are mostly indirect - emissions are not produced by the steel plant, but by the electricity generators that supply electricity to the furnaces. For a typical EAF, direct emissions are usually around 0.06-0.1 t/tcs; indirect emissions can add a further 0.4 t/tCO2. Therefore, scrap-based EAFs are the future of the industry. Interestingly, BOF steel producers are also increasing scrap use, while major European producers are experimenting with recycled metal use in blast furnaces.

Scrap generation to increase in China: WSA has projected that end-of-life scrap generation in China is likely to rise exponentially by 2030. Thanks to mammoth growth in steel production and usage in China since the mid-1990s, great volumes of scrap are expected to be increasingly generated as the current decade progresses. The need to decarbonise China's steel sector, mainly reliant on BF-BOF due to large-scale unavailability of obsolete scrap, will see increased scrap usage from levels of 260 mnt in 2022 to 320 mnt by 2025 and over 350 mnt by 2030, as per estimates by the China Association of Scrap Metal Utilisation (CAMU). Higher scrap generation and use by the world's largest steel producer will boost global consumption.

More EAFs to be commissioned: It is expected that the global ratio of BF-BOF: EAF, which currently stands at 70:30, will gradually change to 60:40 by 2030 as sustainability concerns become more pressing. In developed economies such as the US, EAF's share in steel production is already around 70%. In other developed economies such as the EU, with a BOF: EAF ratio of roughly 55:45 at present, ceaseless scrap availability will naturally encourage the switch to EAFs. In the developing world, which faces shortage of scrap, the switch to EAFs will be facilitated by natural gas-based DRI, to start with, and eventually hydrogen-based DRI for melting in electric furnaces. It should be noted that spiraling carbon prices in different parts of the world will necessitate the switch to EAFs. Leading global steel companies are already trying to make the switch. Some examples are ArcelorMittal in Canada (Ontario) and in Europe (mainly Hamburg) which is seeking to reduce carbon intensity through the DRI-EAF route - envisaging 100% fossil-free DRI by 2030. In China, as per MIIT data, about 100 mnt of fresh EAF capacity will come up by 2030 and scrap will account for around 34% of total steelmaking. The share of EAFs in total steel production is expected to rise to over 20% compared with 12-15% at present. While leading Chinese steelmakers such as HBIS and Baowu Group are investing in hydrogen-based DRI, Indian steel major Tata Steel is investing in new EAF facilities. So, scrap usage is expected to increase manifold.