In 2023, according to data from the Bureau of International Recycling (BIR), global ferrous scrap consumption in key countries (China, EU-27, USA, Japan, Turkey, India, South Korea) was 1% lower compared to 2022, reaching 461 million tons. This slight decline occurred despite increased crude steel production via the BF-BOF route. Additionally, global seaborne scrap trade fell by 5% to 56 million tons, reflecting challenges in the steel market amid economic uncertainties.

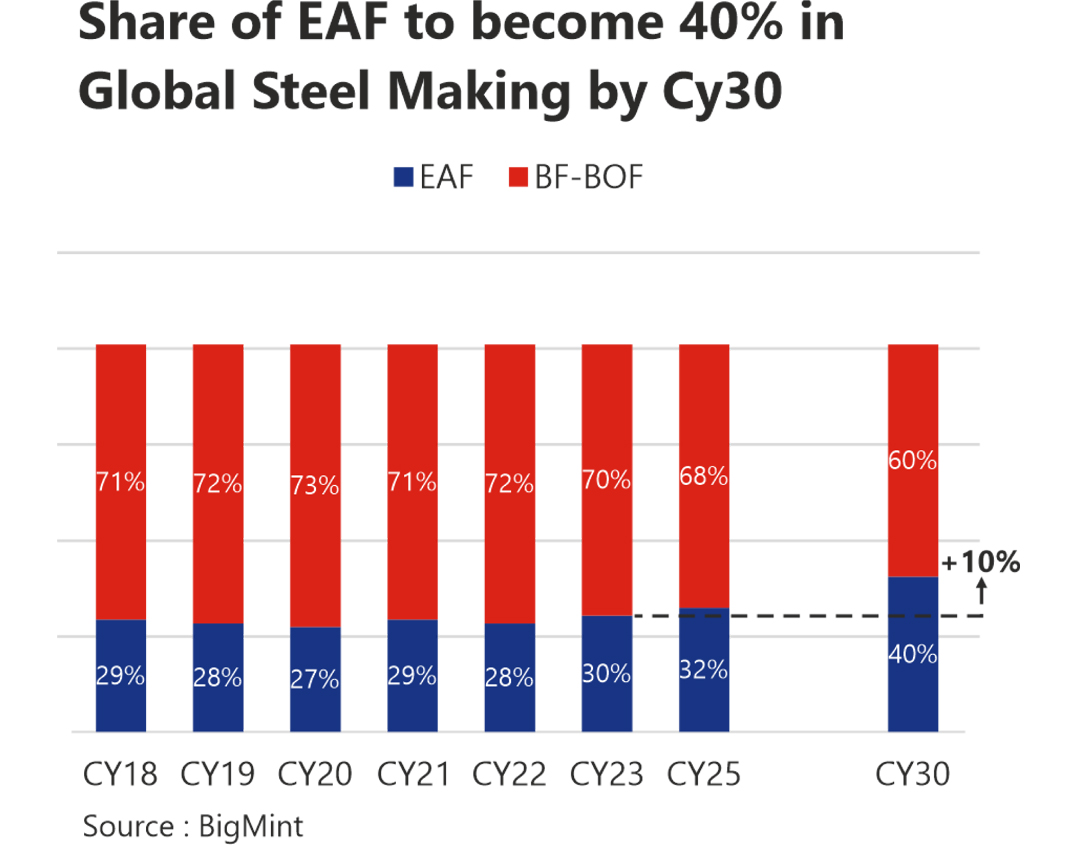

Nevertheless, ferrous scrap remains indispensable for steel industry sustainability and emissions reduction. Scrap-based steelmaking via the EAF route offers significantly lower emissions intensity compared to the traditional BF-BOF route, aligning with global decarbonization efforts. Developed economies like the US and the EU are increasing EAF utilization due to abundant scrap availability. Spiraling global carbon prices will further accelerate the shift to EAFs. Achieving decarbonization goals requires access to low-carbon embedded DRI and high-quality ferrous scrap, particularly in Asia. However, the increase in EAF capacity in many countries may tighten global scrap availability, prompting advanced economies to prioritize domestic decarbonization, while emerging economies should diversify supply sources and enhance domestic scrap sector organization. In South Asian economies, ferrous scrap usage will be influenced by shifts in overseas scrap availability. Despite this, BF-BOF capacity expansions in Asia may lead to increased scrap usage in BOF steelmaking to mitigate greenhouse gas emissions.

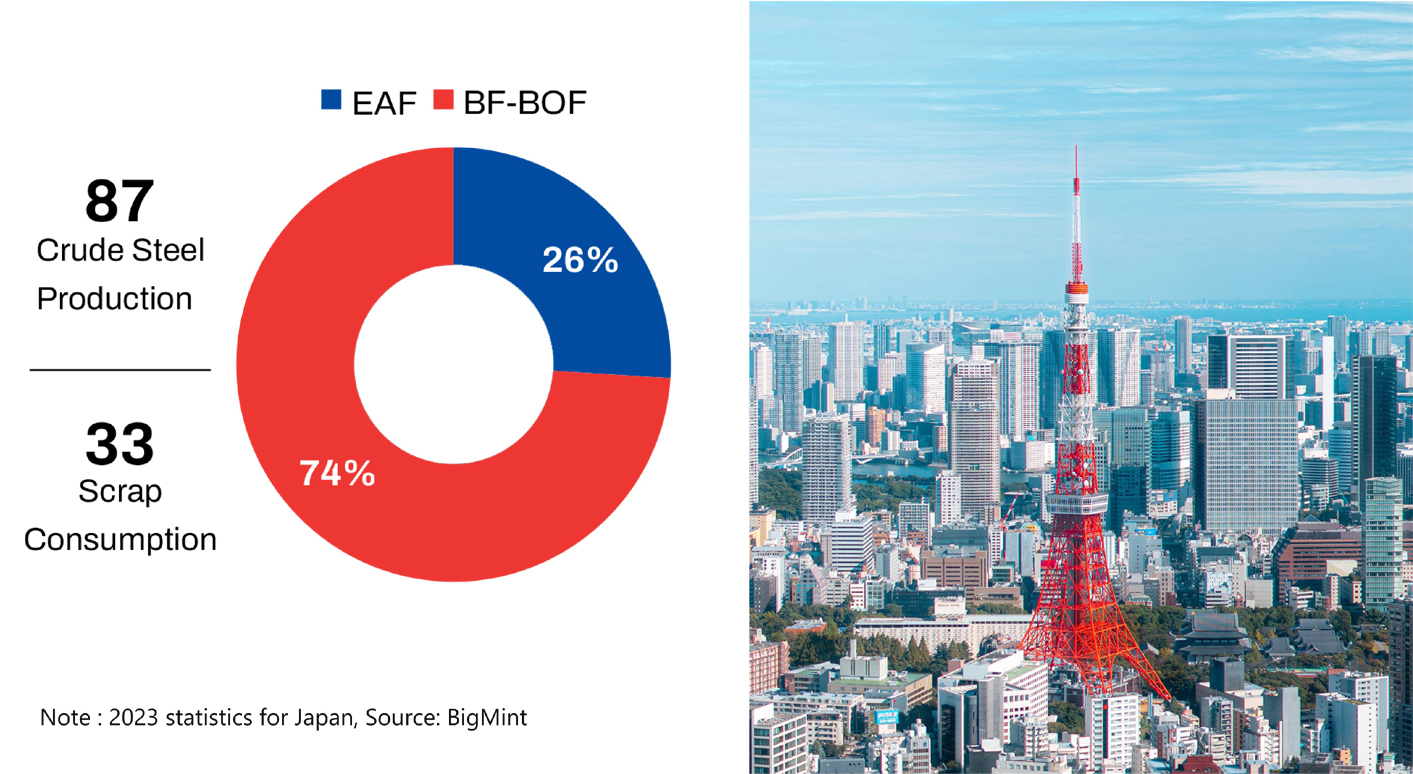

Japan, the world’s 3rd largest steel producer and the 4th largest in ferrous scrap generation and consumption, holds significant influence in global steel and scrap markets. As the 3rd largest scrap exporter worldwide, Japan is a major supplier to Southeast and Far East Asian markets, particularly dominating the South Asian scrap sector. Its strategic position and production capacity greatly impact regional and global scrap trade dynamics. While Japan has historically been a key scrap supplier to Asia, the increasing demand for scrap due to decarbonization efforts necessitates an understanding of potential shifts in export patterns

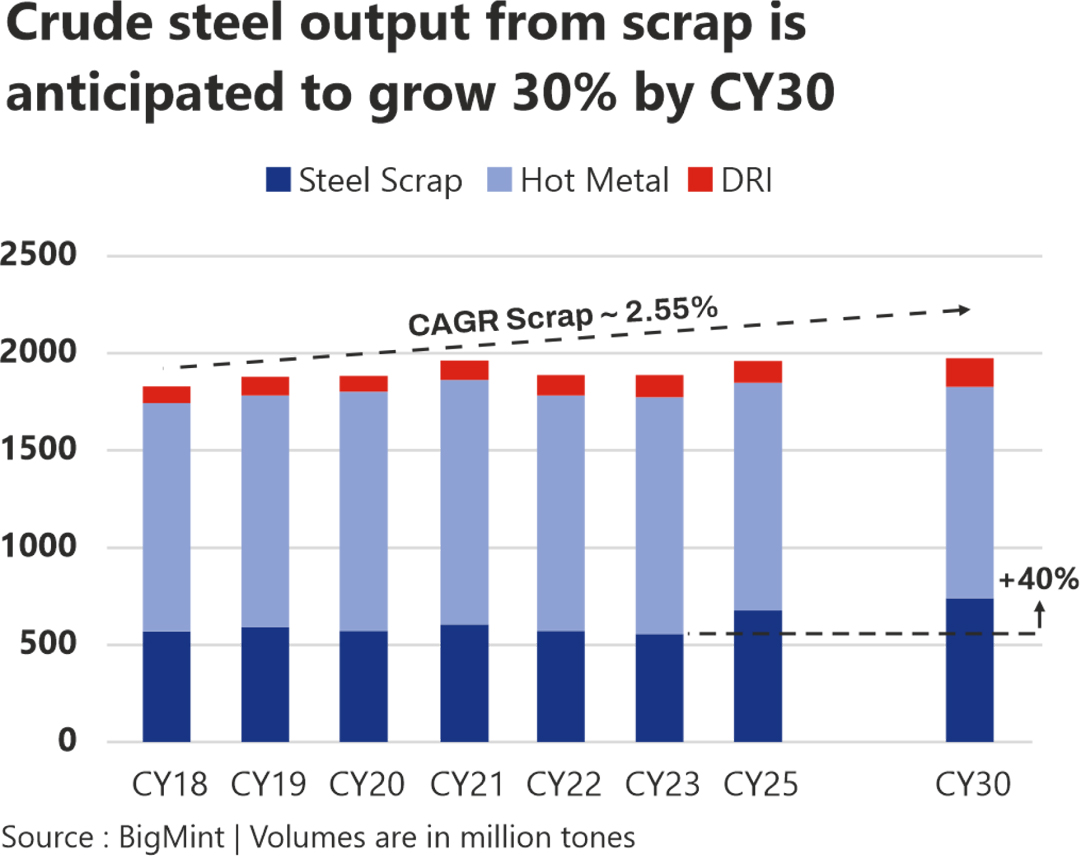

The global demand for scrap is expected to experience a compounded annual growth rate (CAGR) of approximately 2.5% by the year 2030. This surge in demand is attributed partly to the rising preference for scrap as a primary material in steel production, particularly as industries aim to mitigate carbon emissions from their sourcing of raw materials. By 2030, scrap is projected to represent 40% of crude steel production by volume, an increase from the current 30%.

The rising demand for scrap is fueled by several ongoing trends, notably the transition to electric arc furnace (EAF) steelmaking, which relies on recycled steel scrap. This shift away from traditional blast furnace methods is further augmented by an increase in the use of scrap in existing blast furnace operations. Over the next decade, EAF plants, which currently represent about 30% of steelmaking capacity, are expected to grow to over 40% by 2030, driven by new EAF based plants opening in Europe and China.

The International Steel Scrap Conference 2024 to be held in Tokyo…. will shift the spotlight on these pressing issues that are the forefront of the global steel industry’s low-carbon transition.

The International Steel Scrap Conference 2024 to be held in Tokyo…. will shift the spotlight on these pressing issues that are the forefront of the global steel industry’s low-carbon transition.

Intergrated

Steel Mills

Scrap processing

Companies

Trading

Firms

Banks

Security

End-users

20 + Speakers

15 Sessions

Location: Hilton Odiaba Tokyo, Japan