India's ferrous scrap imports may dip by 30% in FY'25. Can decarbonisation efforts alter the declining trend?

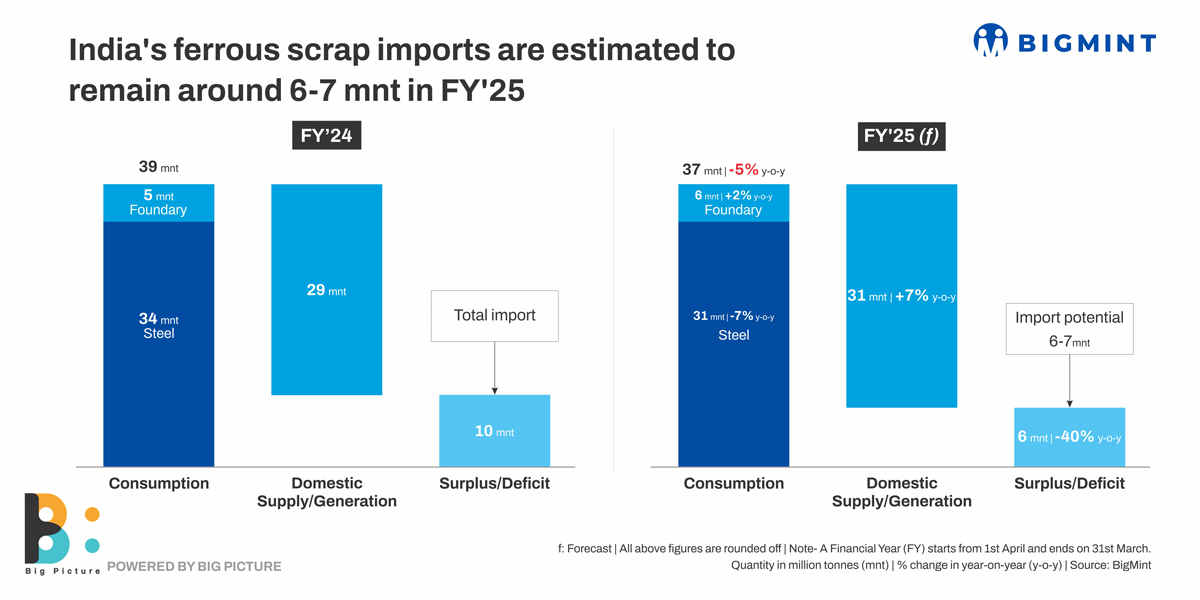

India's ferrous scrap imports are likely to see a significant over 30% decline to ~7 million tonnes (mnt) in financial year 2024-25 (FY'25) compared to 10 mnt in the previous fiscal, as per BigMint's analysis.

Data reveals, ferrous scrap as a feedstock will be lower this year owing to higher hot metal and DRI production. It is projected that scrap consumption in the current fiscal will be at 37 mnt against the almost 39 mnt seen in FY'24. Scrap usage in steel-making in particular is expected to drop to 31 mnt in FY'25 from 33.5 mnt in FY'24, while foundry usage will remain more or less stable at around 5.5 mnt.

Interestingly, even while India's scrap consumption is seen falling in FY'25, DRI consumption is set to rise to 54 mnt from the current 50 mnt in this period, while pig iron intake may dip slightly to 6 mnt from the present 7 mnt.

Reason why scrap imports may fall in the current fiscalHigher hot metal production: Since most of India's capacity expansions had been planned prior to the government's net zero pledge, these will be mainly through the blast furnace route. Several new BF capacities will be added this fiscal. These include Tata Steel's Kalinganagar works, JSW Steel's Vijayanagar complex and JSPL's Angul plant. Naturally, under such circumstances, pig iron and hot metal production will go up in tandem and be a key reason for edging out scrap usage. India's hot metal production is seen rising to 87 mnt this fiscal and further to 95 in FY'25.

Higher sponge iron production: India's sponge iron production has been showing a steady increase. From 43 mnt in FY'23, it has climbed to 51.5 mnt and is headed further north to 54 mnt in FY'25. The reasons lie in the higher margins, lower production costs thanks to the comparatively cheaper coal and the bonus is the additional power these units are able to generate through the waste heat recovery process. Sponge iron is a competing raw material and can replace scrap as a feed because of its easier availability and comparatively lower prices.

Relatively lower crude steel production in India: India's crude steel production is set to rise but the pace of growth may slow down to around 8-9% compared to the 13% seen in the last couple of years. Despite India being the brightest spot amongst all steel-consuming countries, demand has been a tad subdued ahead of the elections and this trend may not waver too much in the days to come along with a dull export scenario. Lesser crude steel production will also entail lower scrap usage as a raw material.

Turkiye, B'desh to resume scrap buying as economies improve: Globally, economies of scrap-importing countries like Turkiye and Bangladesh are improving after a couple of poor growth years marked by inflation and high energy prices. Both, being fully dependent on scrap for steel-making, buy heavily in bulk. The economic rebound may sustain for the rest of the year, and support higher steel production and a consequent increase in scrap intake. In Turkiye, public infrastructure investments for reconstruction after the earthquake supported steel demand and this trend is expected to continue into the current year even as new capacities have come onstream.

Bangladesh is again showing renewed interest in scrap buying. Its scrap imports over January-April, 2024 are already up 28% y-o-y while Turkiye's is up 6% in this period.

Naturally, global suppliers will show a greater propensity to supply to these two large consumers, which may limit supplies in the seaborne market or to India.

Restrictions on ferrous scrap exports: As countries move towards their respective emission goals, they would want to preserve the scrap generated domestically for their own use. Thus, several are clamping down on scrap exports, especially in regions like Africa, MENA, Asia and Europe. As of the middle of last calendar, more than 60 countries have either put limitations on scrap exports or are in the process of doing so. Eurofer has repeatedly voiced concern over scrap exports while European and Australian steel producers were heard lobbying for a policy tightening for the same.

Role of primary steelmakers in coming years: India aims to develop a globally competitive steel industry with a production capacity of 300 million tonnes per year by 2030. According to the National Steel Policy of 2017, 35-40% of this capacity is expected to come from electric-arc furnace (EAF) and induction furnace (IF) steelmaking routes.

Major Indian primary steelmakers like Tata Steel, JSW Steel, and ArcelorMittal Nippon Steel are ramping up their scrap intake in response to the decarbonisation push. This strategic move aligns with India's goal to enhance steel production through sustainable methods.

Looking ahead, decarbonisation and green steelmaking present both challenges and opportunities. While domestic scrap generation is rising, it may not meet the growing demand, potentially creating a 12-15 million tonne annual deficit. Indian mills will need to balance cost-effective production with sustainability goals to address this gap as scrap is becoming a scarce commodity globally. Thus, a question mark arises on whether India will become self-sufficient in domestic scrap or fall back on its increasing DRI production to satisfy green raw material needs?