India's metallurgical coal imports rise 10% y-o-y in Jan-May'24

- Met coal imports reach nearly 32 mnt in 5MCY'24

- High-grade coal imports up sharply, weaker grades decline

- Australian shipments drop slightly as mills look to diversify imports

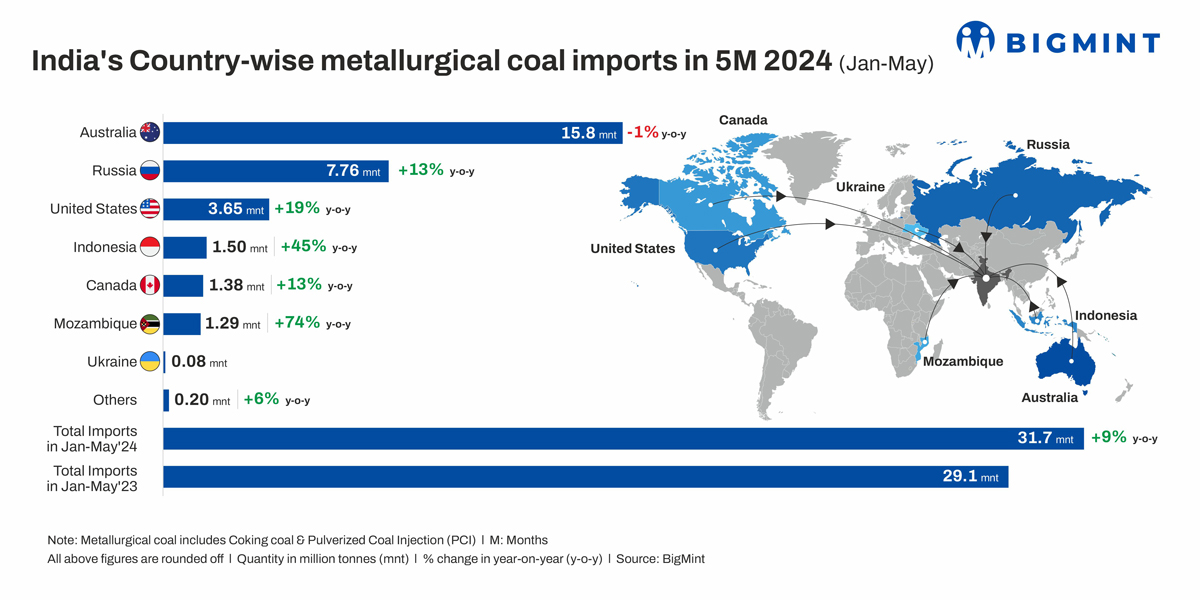

Morning Brief: India's imports of metallurgical coal in January-May 2024 (5MCY'24) stood at 31.7 million tonnes (mnt), an increase of 9% y-o-y compared with 29.1 mnt in 5MCY'23 as per BigMint data, on higher crude steel and hot metal production. India, the world's second-largest steel producer, relies overwhelmingly on imports of this key raw material (over 90% of consumption) to cater to its burgeoning steelmaking needs.

Country-wise imports

Australia shipped over 15 mnt during the period under review, thereby retaining the top spot among exporting countries, while Russia grabbed the second spot with total shipments of 7.76 mnt. Notably, while Australian exports to India fell 1% in 5MCY'24, Russia increased exports by around 13% y-o-y.

Among the other importers, the US raised shipments by an impressive 19% y-o-y in 5MCY'24 to 3.65 mnt even as Indonesian imports surged 45% y-o-y to 1.5 mnt. Notably, Mozambican import volumes increased at the sharpest pace of nearly 75% y-o-y to 1.29 mnt.

Grade-wise imports

Data shows that India's imports of premium coking coal grades increased significantly during the period under review. Hard coking coal (HCC) imports increased by 30% y-o-y to 13.5 mnt, while premium hard coal (PHCC) imports grew 12% on the year to over 6 mnt in 5MCY'24.

In sharp contrast, imports of weaker grades (semi hard and semi soft) witnessed a decline of 11% y-o-y to 5.18 mnt even as purchases of pulverized coal injection (PCI) coals declined marginally by 6% y-o-y around 7 mnt.

Key takeaways

Imports rise as hot metal output grows: As per BigMint data, India's crude steel production increased by 11% y-o-y in 5MCY'24 to over 62 mnt and hot metal output edged up around 4% during this period. This is because production via the BF-BOF route increased around 2% y-o-y. So, higher production was the key driver of met coal imports.

Preference for high-grade coking coal: Imports of hard coking coal and PHCC show a significant uptick y-o-y which reflects the ambition of domestic steel mills to enhance energy efficiency in blast furnace ironmaking and optimise production, market sources informed BigMint. "High-grade met coke is an enabler for blast furnace steel producers to ensure energy efficiency and reduce carbon footprint in a gradual way," the source explained further, pointing to the pressure on mills to optimise energy use and implement carbon abatement measures.

PCI imports largely stable: Although imports of PCI show a marginal reduction in 5MCY'24, the general trend over the last few years reveals a consistent increase in imports by the BF-based mills to control costs. "The PCI rate per tonne of hot metal in the BF has the potential to rise to a level of 180-220 kg from an average level of 150-180 kg," a domestic mill source informed. Some State-owned mills still have a low rate of around 110-120 kg, which they intend to raise to 150 kg in the coming time, sources said. Moreover, all the leading technology and equipment providers are designing furnaces for Indian buyers with injection systems that can easily ensure above 200 kg per tonne of hot metal.

The slight dip in PCI imports probably points to lower Russian supplies amid the rouble-linked export duty on coal, existing problems with logistics in the Russian Far East which impede higher coal exports, and the sanctions imposed on Russia. Taken together, these imply higher costs for Russian miners. Russia is the top supplier of PCI coals to India and intends to use transport networks through Iran to ship coal to India in the coming years.

Australian exports keep declining: At around 16 mnt in 5MCY'24, Australian coking coal and PCI imports by India maintained an overall general trend of decline. Imports from Down Under had decreased by 5% y-o-y in FY'24, as per data. Although Australia is the prime supplier of high-grade coking coal, price volatility has been a recurring problem and Indian buyers are seeking to diversify imports - a key reason behind higher imports from Russia and the US.

Even sourcing of coal from African countries has increased phenomenally to ensure a diversified import base: for example, major Indian mills are investing in coking coal assets in Mozambique to gain control of this critical asset for the Indian steel industry.

Outlook

Estimates point to consistent growth in domestic steelmaking capacity in 2024, with the majority of the 15-16 mnt addition of new capacity to happen from the BF-BOF route. Therefore, the share the BF-BOF route in India's steel production, which stood at 43.6% in 2023 according to WSA data, is expected to rise from here on and higher met coal consumption and imports will necessarily be required to sustain increased hot metal production.

On the supply front, if Russian shipments slow down markedly, seaborne supplies may come under slight pressure in H2CY'24. This may impact domestic steel producers.

4th India Coal Outlook Conference

How will Indian mills devise long-term strategies to combat supply insecurity and price volatility amid geopolitical and trade imbalances? How will India's coking coal demand-supply metrics change in 2024 and beyond? How is decarbonisation likely to affect the coking coal sector worldwide? Hear experts deliberate these issues and more during the session on 'Assessing India's Coking Coal Demand-Supply Outlook at BigMint's 4th India Coal Outlook Conference to be held in Gurugram, Haryana, over 22-23 August 2024. Book your seat now