Global Metallurgical Coke Exports Down 5% in 2023, According to BigMint

- Coke exports recorded at roughly 27 mnt in CY'23

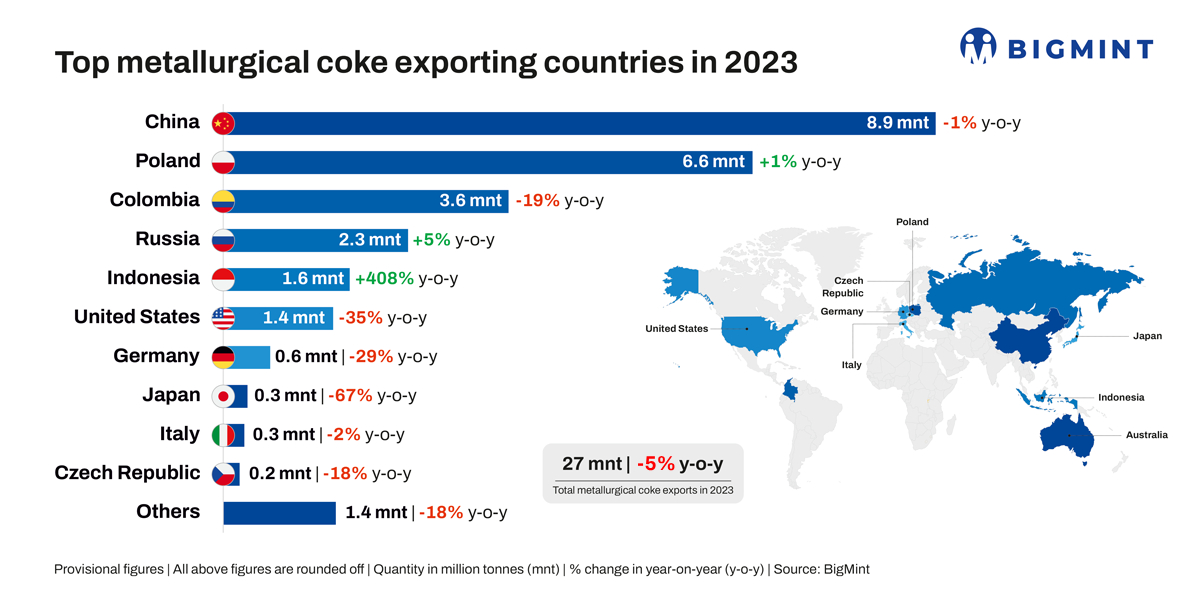

- China top exporter, while Colombia, US see sharp drop in shipments

- Merchant coke market to shrink further on rapid growth in captive capacity

Morning Brief: Global seaborne metallurgical coke export volumes decreased around 5% y-o-y to 27 million tonnes (mnt) in 2023 from around 28.5 mnt in 2022, as per provisional data available with BigMint.

Global crude steel production, according to the World Steel Association (WSA), increased by a meagre 0.11% y-o-y in 2023 to 1.892 billion tonnes (bnt), with China accounting for roughly 54%. Notably, the share of the BF-BOF route in China's steel output was estimated at over 90%. China's crude steel production remained flat at 1.019 bnt in 2023.

Leading exporters

Global coke exports recovered somewhat in H2CY'23 from the 12% drop seen in January-June 2023. The reduction in coke exports occurred amid a drop in global steel production in the first half of 2023. Among the top exporters, China shipped around 8.8 mnt, largely stable on year, while Poland increased exports marginally to around 6.6 mnt.

However, Colombia and the US witnessed a decrease in export volumes: while the former shipped around 3.55 mnt, the latter recorded total exports at roughly 1.4 mnt.

On the other hand, Indonesian exports surged phenomenally to around 1.57 mnt in 2023, as per data, on the back of significant expansion of coke-making capacity in that country, thanks to a steady flow of Chinese investments over the years, amid low domestic demand.

How coke trade dynamics evolved in CY'23?

Global commercial coke supplies drop: Merchant met coke supplies worldwide reveal a general trend of decline, with seaborne trade dropping around 10% since 2022, as per BigMint data. This is because as steelmaking capacity through the BF-BOF route expands in India, Southeast Asia, Brazil and elsewhere, captive coke production capacity is also building up simultaneously. In 2022, steel plants around the world consumed about 576 mnt of coke and the volume of trade amounted to 28.45 mnt. So the global share of captive production of coke for steelmaking is more than 95% and, only about 5% of demand is met by commercial supply.

Sharp drop in volumes from US, Colombia: The US and Colombia, both major exporters of coke and coal, witnessed sharp decline in export volumes in 2023: while US shipments fell over 35% y-o-y, Colombian exports decreased by roughly 20%. The US' exports to its main market, the EU, fell due to low demand for steel in Europe, particularly countries that witnessed a decline in crude steel production in 2023 such as the Netherlands and Spain. Energy prices began to stabilise in 2023, so European market participants began to resell cargoes of coal and coke to Asia in order to minimise stocks accumulated due to excessive purchases after the beginning of the Russian invasion and gas supply restrictions.

Excessive pressure on Colombian ports, on the other hand, due to the surge in coal and coke exports in recent years has posed a challenge for exporters. Colombian coal exports in 2023, too, declined by 1% y-o-y due to logistical constraints.

Japanese coke exports down 70% y-o-y: Coke exports by Japan fell sharply to around 0.3 mnt in 2023 from 0.91 mnt in 2022 and 2.78 mnt in 2021. Despite softening domestic steel production in Japan, environmental restrictions weigh on the coke industry. Moreover, the rapid growth in coke-making capacity in Asia, especially Indonesia, and declining supplies to major buyers such as India have contributed to the steady de-growth in Japanese seaborne supplies of coke.

These factors impacted global coke exports in 2023.

Outlook

India is planning to place quantitative restrictions on coke imports and increasing domestic capacity fast to counter burgeoning imports. Crude steel production through the primary route in the EU is witnessing a gradual rollback. In view of soft demand from these two key importing blocks, and given the rapid growth of captive capacity globally, the seaborne met coke market is expected to shrink further.

On the other hand, China is focusing on integrated facilities replacing standalone coke and sinter plants with an eye on curbing excess domestic capacity. Therefore, Chinese coke exports, too, may gradually dry up in the coming years.

However, steel output control measures in China in H2CY'24 may just prompt Chinese cokeries to seek out foreign buyers amid low domestic demand. Also, if global coking coal prices remain firm for an extended period, Indian and other Asian buyers may be tempted by cost-competitive imports, mainly from China.

4th Indian Coal Outlook Conference

With fast-paced expansion in India's steel production via the BF-BOF route, what will be the rate of expansion of the domestic coke industry in the years to come? Will government regulations to rein in imports affect the domestic industry adversely? What challenges are the merchant coke producers likely to face in the short- to mid-term? These issues and more will be discussed in-depth during the session 'Exploring the Viability and Future Path of the Metallurgical Coke Industry in India' at BigMint's 4th Indian Coal Outlook Conference to be held in Gurugram, Haryana over 22-23 August 2024. Be there