In a dynamic economic landscape, the steel industry holds immense significance for India. The Indian steel industry contributes significantly to the country's GDP, accounting for around 2%. As India aims to become a $5 trillion economy, the steel sector will undoubtedly play a pivotal role in achieving this ambitious goal.

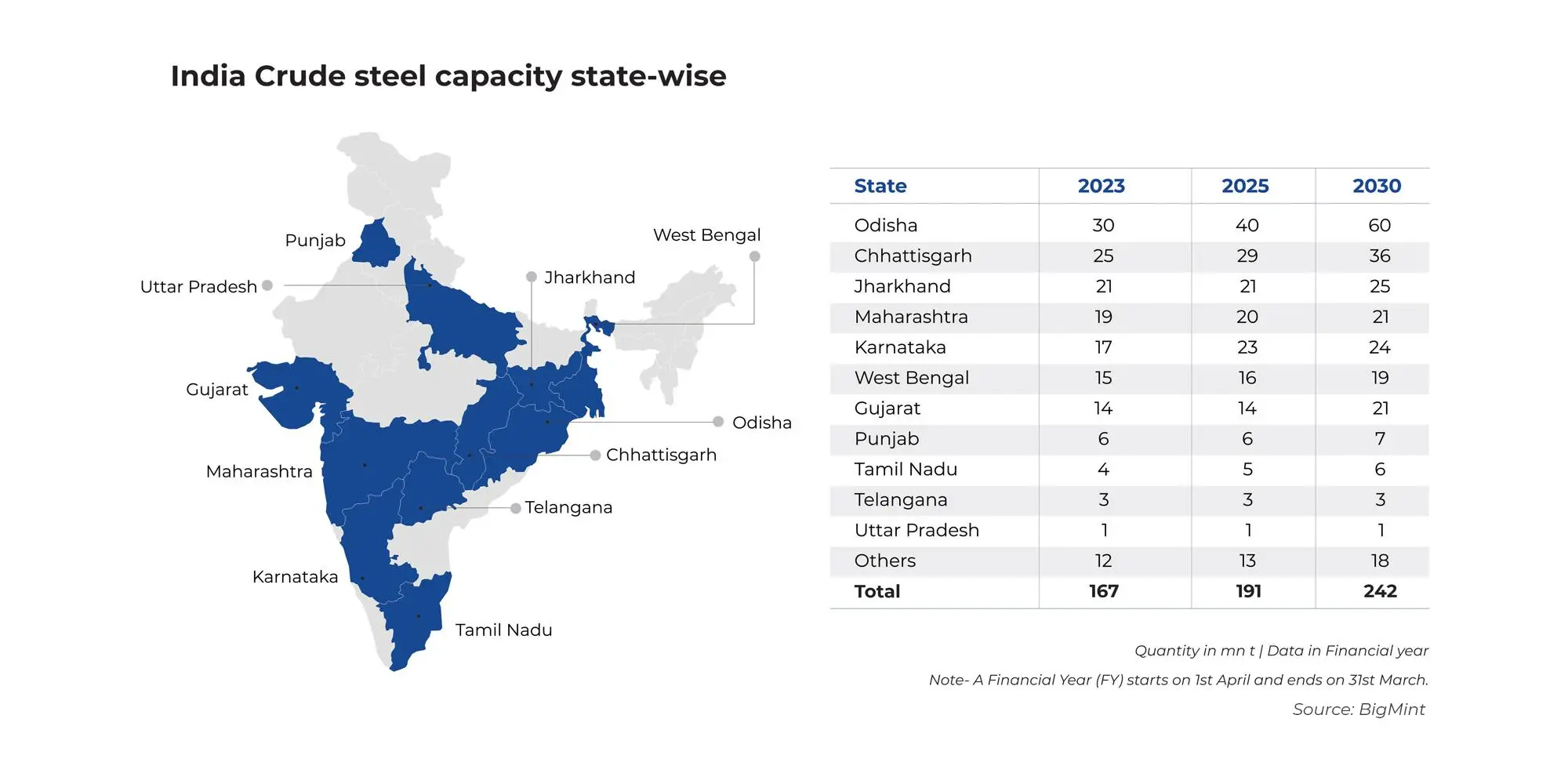

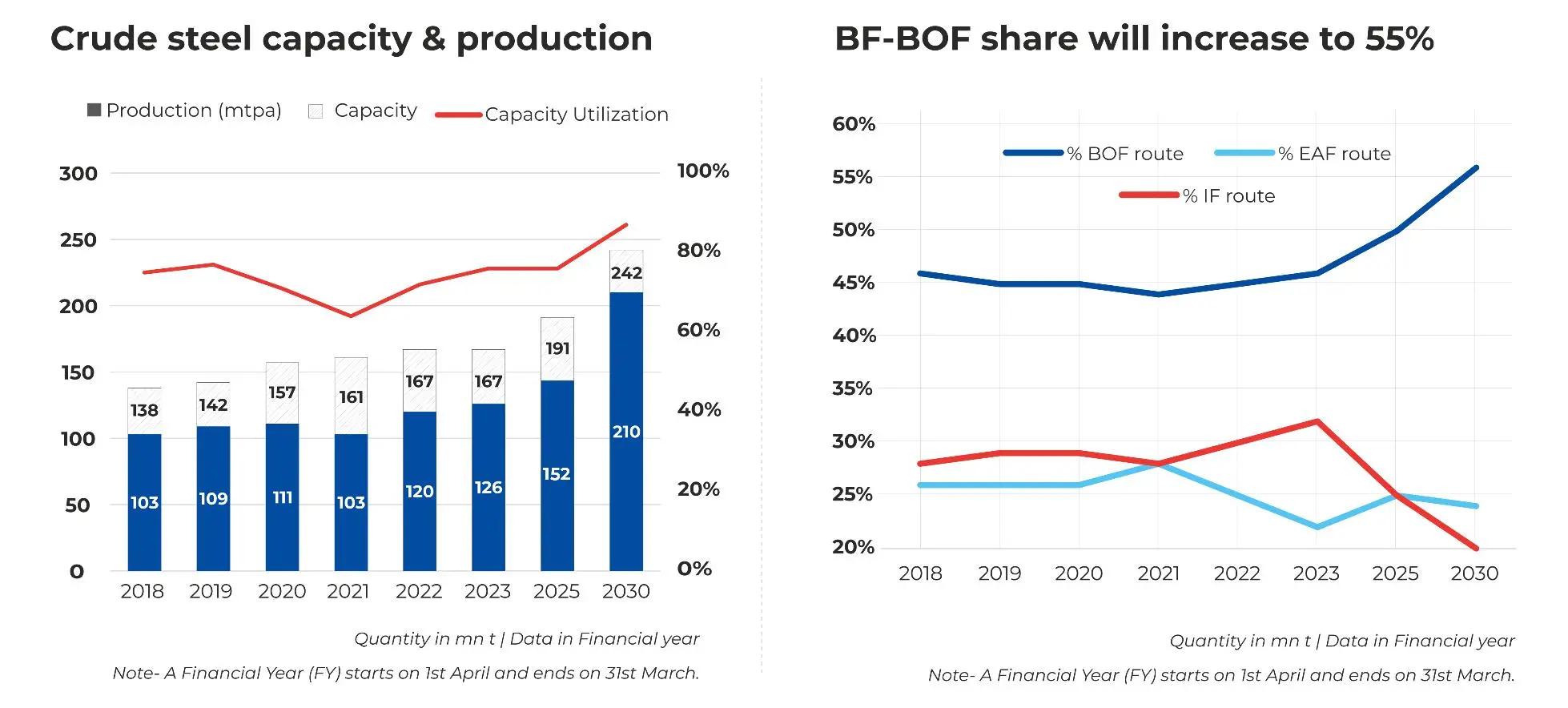

The Indian steel industry is an emblem of the nation's economic prowess, which is forging new pathways of growth and development. India is currently the second-largest producer of steel globally after China. With an annual production capacity exceeding 170 million tonnes (mnt) which is expected to rise to around 230-240 mnt by 2030, the steel industry employs millions directly and indirectly and is the backbone of a whole gamut of sectors ranging from construction and infrastructure to automotive and industrial machinery.

The industry has seen rapid expansion fuelled by increasing domestic demand, infrastructure projects, and urbanisation. This growth is bolstered by government initiatives such as 'Make in India' and infrastructure development schemes.

Beyond its economic impact, steel symbolises resilience and progress, building the bridges and skyscrapers that define modern India. However, challenges like global price fluctuations and environmental concerns loom large. As India strives towards sustainable development goals, the steel industry must innovate, embracing cleaner technologies and efficient practices.

We are pleased to announce a series of steel conferences across the four key regions of the country: North, South, East, and West. BigMint's initiative is geared towards bringing all industry stakeholders on a common platform to address the issues affecting them most and also to find ways to develop the yet-untapped potential of the entire value chain. Through in-depth discussions led by industry leaders, FUTURE.STEEL seeks to engage stakeholders in the common pursuit of unlocking the industry's full potential.

In the early 20th century, India's steel industry was still a toddler when Mandi Gobindgarh's industrious residents adopted a steely resolve to develop this township into a booming iron-making hub. Today, Mandi-Gobindgarh and Ludhiana are the two principal steel-producing cities in Punjab.It is now known as the “Steel City” or Loha Mandi (in local parlance) of Punjab.

This event will cast a spotlight on Punjab's strategic role in shaping the industry's future, offering a deep dive into the latest trends, policies, and market dynamics that are steering steel production. It will seek to address the challenges posed by GST regulations and their impact on business sustainability, particularly in the context of the finished long steel market which faces raw material scarcity in the northern region of the country.

Punjab offers a competitive edge, thanks to the State Government's conducive policies and strategic benefits that are attracting steel plant investments. Don't miss the chance to engage with experts to master strategies for optimising the scrap-to-Direct Reduced Iron (DRI) ratio and learn to navigate the complexities of scrap imports in the face of domestic supply constraints. Participate in insightful discussions on price discovery in Mandi and how they compare with international and domestic steel benchmarks.

Total crude steel production for India stands at 144 million tonnes.

Odisha emerged as the major crude steel producer in FY’24, contributing 26 million tonnes, followed by Jharkhand with 20 million tonnes and Chhattisgarh with 18 million tonnes.

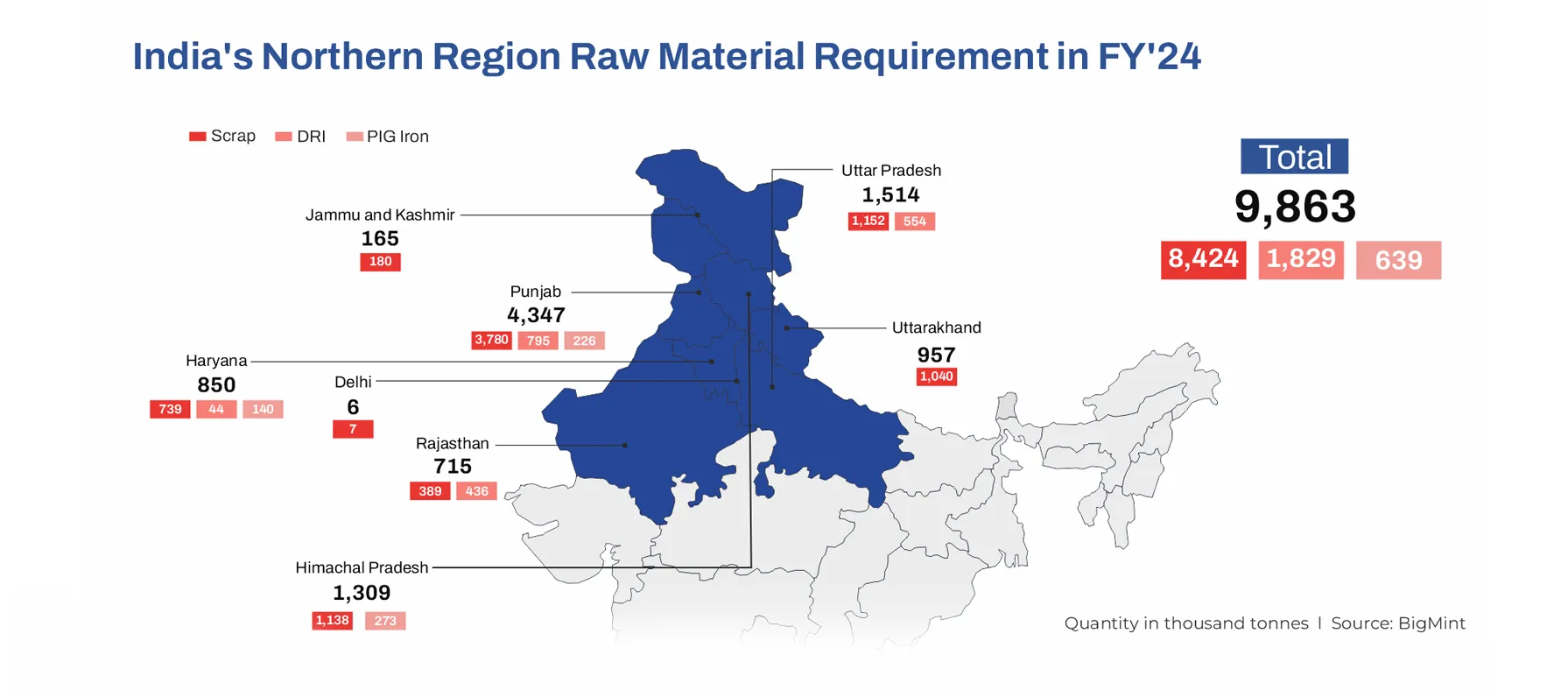

Scrap is the major feedstock in the steel industry of the northern region with an 85% share.

Scrap is sourced either domestically or through imports via the Gujarat-based port of Kandla.

The respective shares of DRI & pig iron in crude steel production in the northern region are 18.54% and 6.47%.

In the northern region, the majority of steel mills utilise various grades of domestic scrap including HMS (80:20), light melting scrap, end-cutting scrap, CR busheling, turning boring, and cast iron scrap, while imported shredded scrap and HMS (80:20) are used by mills.

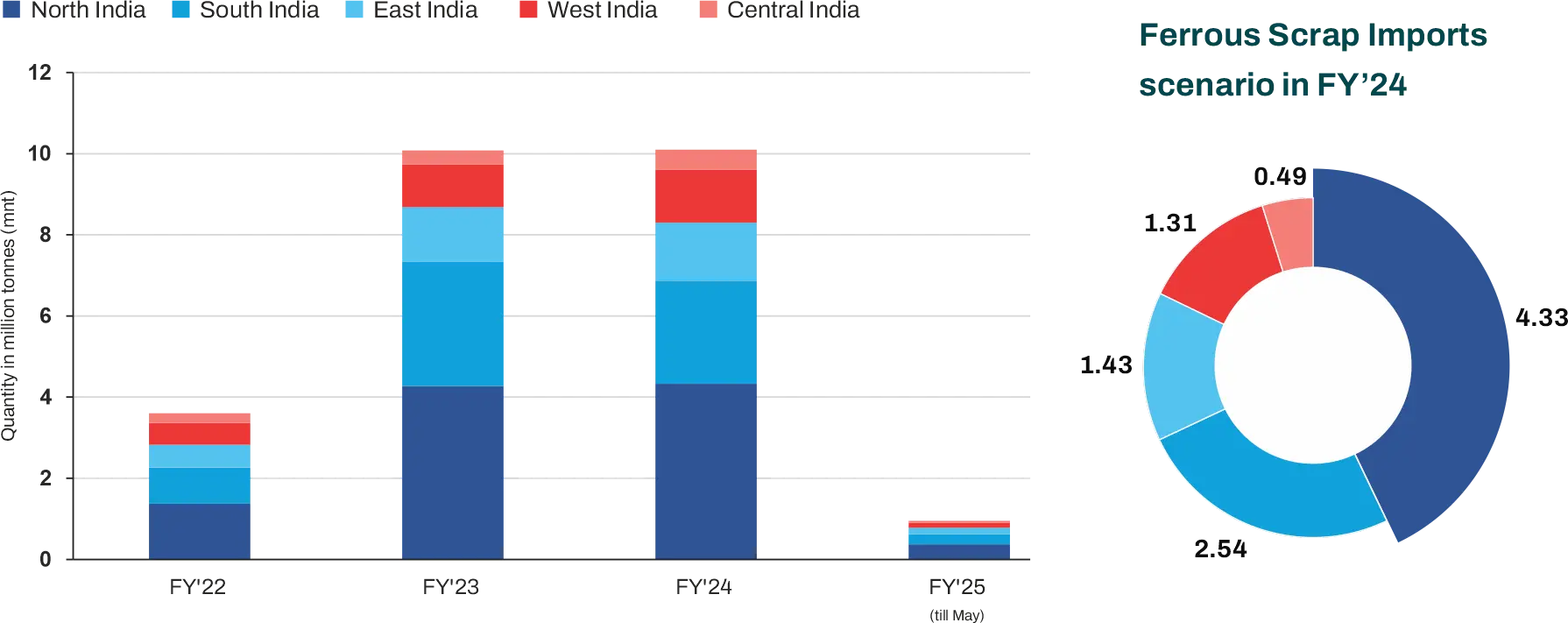

North Indian mills consumed approximately 4.33 mnt of imported scrap in FY'24 underscoring the critical role that imported scrap plays in the region’s steel production.

India aimed to achieve a steel capacity of 300 million tonnes by 2030-31 according to the National Steel Policy 2017. While the industry was making progress, the COVID-19 pandemic has set back the target by 2-3 years. As a result, the capacity of crude steel is expected to reach 242 million tonnes by 2030.

Bigmint predicts that steel production will reach 210 million tonnes by 2030, assuming a 7-8% compound annual growth rate (CAGR).

Bigmint also projects that by 2030, the Basic Oxygen Furnace (BOF) steelmaking route will increase to contribute 55%, while the sum of Electric Arc Furnace (EAF) & induction route will remain at 45%.

If you attended previous conferences and want to participate in the programme again, then please hurry and get your Download Participants List!

Download Participants ListRegistration

This curtain-raiser will provide an overview of India's current steel capacity and expansion plans in crude steel, pellets, and DRI, focusing on trade dynamics. It will highlight Northern India, particularly Punjab, in terms of steel industry growth and changing raw material needs.

Esteemed Speakers:

How are mills in North India currently sourcing raw materials, and how will this change by 2030? What is the outlook on shifting raw material preferences? Will regional markets transition from ferrous scrap to DRI?

Esteemed Speakers:

Networking Lunch

Esteemed Speakers:

Networking Tea

Esteemed Speakers:

This technical session will be a master class on best melting practices in the IF, focusing on P-DRI's potential for improving eciency and cost optimization. Case studies from mills across the country will highlight best practices in steel melting and cost management

Esteemed Speakers:

Cocktail & Networking Gala Dinner

Esteemed Speakers:

Esteemed Speakers:

Esteemed Speakers:

Networking Lunch

Esteemed Speakers:

If you want to attend this conference and participate in the programme, then please hurry and register now!

Register Now

30-August-2024

India's ferrous scrap imports increased by approximately 38% m-o-m in July, reaching 0.87 million tonnes (mnt) compared to 0.63 mnt in the previous month, according to BigMint's latest data. Scrap imports surged 26% y-o-y from 0.69 mnt reported in July 2023.

16-August-2024

Global ferrous scrap trade volumes, excluding intra-European Union (EU) trade, dropped 6% y-o-y in January-June, 2024 (H1CY'24), BigMint data shows. Total scrap imports in H1 declined to around 25.9 million tonnes (mnt) compared to 27.5 mnt in H1CY'23.

10-August-2024

India's ferrous scrap imports declined by 26% in the first half of calendar 2024 (H1CY'24) to around 4 million tonnes (mnt) against 5 mnt recorded in the same period in CY'23, reveals data maintained with BigMint.

Mr. Ajeet Singh

+91 90092 22344

ajeet@bigmint.co

Mr. Faizan Raza

+91 95751 00430

faizan@bigmint.co

Yashika Agrawal

+91 99939 03483

yashika@bigmint.co