14-June-2024

- Power consumption rises 10% in 5MCY'24 amid searing heatwave in country

- Share of coal-fired generation rises y-o-y, large hydro down sharply

- Higher-than-moderate growth in coal imports expected in current year

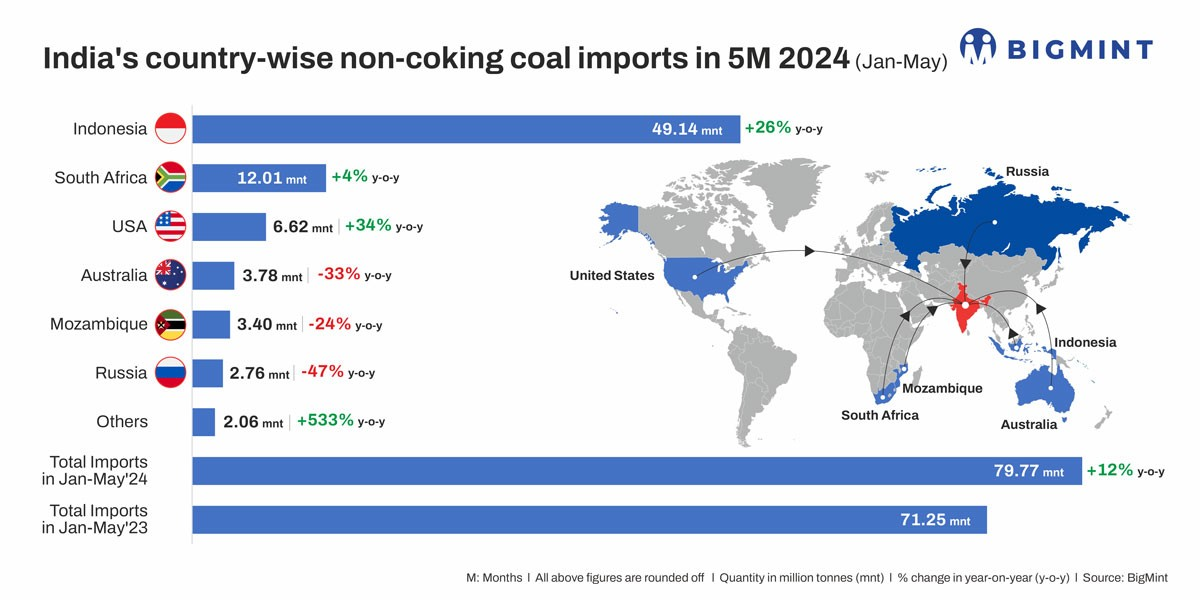

India's imports of non-coking coal, largely used in power generation as well as other industrial applications, increased by 12% y-o-y to nearly 80 million tonnes (mnt) in January-May 2024 compared to a little over 71 mnt in the same period of last year, as per data collated by BigMint.

India's imports of non-coking coal edged up by around 10% y-o-y in 2023 to close to 180 mnt, as India's economic and infrastructural growth put increased burden on energy consumption and domestic resources. Over 80% of India's thermal coal demand is for power generation. India's current electricity generation mix constitutes coal (77%) followed by renewables (23%).

The traditional coal exporting countries were all at the forefront: Indonesia remained the largest exporter to India at 49.1 mnt in 5MCY'24 followed by South Africa (12 mnt) and USA (6.6 mnt) respectively.

Notably, India's thermal coal imports shot up in the first five months of 2024 despite a growth of 10% in domestic production of non-coking coal, which reached around 445 mnt compared with a little over 404 mnt in January-May 2024. State-run miner Coal India Ltd. (CIL) accounts for over 80% of India's coal production.

Why are imports drifting higher in CY'24?

Continued rise in power demand: A lion's share of India's imports of non-coking coal are used up in the power sector which, according to CEA estimates, is growing at a CAGR of 8-10% in sync with the country's overall economic growth. BigMint data reveals that India's power consumption in the first five months of the current calendar year touched 700,855 million units as against 639,304 million units - an increase of roughly 10% y-o-y.

This is because the country was in the grip of a sustained heatwave since end-April, with temperatures nearly touching 50 degrees Celsius in many parts of India. Meeting this unprecedented growth in power demand meant keeping adequate level of coal stocks at power plants.

Rise in coal-fired generation: The share of coal in India's power generation increased from roughly 74.4% in January-May last year to over 75% in the same period of the current year. The share of large-scale hydropower in meeting the nation's electricity demand fell by over 10% y-o-y due to erratic rainfall patterns and, consequently, low reservoir levels. Despite the marginal increase in generation through renewable sources, high intermittency and storage costs have reinforced the dependence on thermal coal.

Govt. diktat on coal imports: The Ministry of Power has extended a mandate on imported coal-based power plants to operate at full capacity until 15 October to meet the anticipated high demand for electricity in the summer months, with peak demand expected to cross 260 GW compared with 243 GW last year. This puts the onus on imported coal-based power plants (ICBs) - despite global commodity volatility - to persist with coal imports in order to continue operations in a seamless manner.

India's increasing sponge iron production: The rapid increase in India's sponge iron capacity has seen monthly average production exceeding 4.5 mnt in 2024 compared with well under 4 mnt in the year-ago period. Imported South African thermal coal is higher in fixed carbon and lower in VM, and is required around 0.8 t for every tonne of sponge iron, whereas domestic coal requirement exceeds 1.3-1.4 t. Therefore, imports are preferred.

Outlook

India remains one of the few markets expected to witness an increase in thermal coal demand over the next decade. The degree to which this increase will flow through to the seaborne market will depend on the country's ability to increase domestic production and the capacity of associated logistics networks to reliably ship at the necessary scale.

The IEA's World Energy Outlook 2023 forecasts that India's coal powered generation will increase till 2030 in contradistinction with the western world as well as China. Although India's coal production is expected to rise over time, it is not expected to keep pace with demand, and so a higher-than-moderate lift in seaborne imports is expected in 2025.

4th India Coal Outlook Conference

Will India be able to rein in thermal coal imports in the near term given the exponential growth in domestic production and the government's renewed thrust on logistics and last mile connectivity? Follow the debate at the 4th India Coal Outlook Conference to be organised by BigMint over 22-23 August 2024 in Gurgaon which will feature a brainstorming session on 'Will the government be successful in cutting thermal coal imports in the mid-term - Prospects & Challenges'. Book your seat now.

- Register »

- Download Brochure

- Download Schedule »

- Venue: The Leela Ambience Gurugram, Haryana, INDIA