About The Conference

BigMint India Non-Ferrous Week is a two-day premier industry forum designed to bring the entire non-ferrous value chain together—producers, recyclers, traders, policymakers, technology providers, and end-use manufacturers. The event explores how aluminium, copper, zinc, lead, nickel, tin, and other non-ferrous metals are shaping India’s industrial growth and how global market forces are reshaping trade flows, pricing, and investment decisions.

India is rapidly evolving into a major hub for both primary and secondary non-ferrous metals. As demand expands across infrastructure, automotive, mobility, power equipment, renewables, electronics, and consumer applications, the sector is entering a new phase of complexity and opportunity. The conference will unpack these shifts, connecting long-term market drivers with the realities on the ground—supply gaps, raw material constraints, regulatory transitions, technology adoption, and the growing need for reliable pricing and intelligence.

Designed as a platform for practical insights and meaningful dialogue, the event offers a mix of strategic outlooks, data-backed discussions, and case-led sessions. The conversations will highlight how global trade realignments, decarbonization pressures, policy reforms, and digital transformation are influencing decisions across the non-ferrous ecosystem. Through these discussions, the event aims to help businesses plan for the next decade with clarity and confidence.

Objective

The objective is to build a strong, connected non-ferrous community and offer a dedicated space where industry participants can exchange knowledge, explore market opportunities, and collaboratively address challenges. The forum is structured to help stakeholders understand market developments, identify actionable strategies, and align long-term plans with India’s emerging opportunities.

Conference Highlights

- Data-backed insights on global and Indian demand, supply, and pricing across key non-ferrous metals.

- Understand the impact of tariffs, trade policies, and global market shifts on Indian operations.

- Practical strategies for procurement, sourcing, and inventory optimization.

- Expert forecasts to navigate price volatility, raw material risks, and market cycles.

- Deep dive into decarbonization, recycling, and green-metal opportunities.

- Policy intelligence on EPR, PLI, GST, mining reforms, and regulatory shifts.

- Technology-led pathways through AI, automation, and digital plant integration.

- Networking platform for new partnerships across producers, recyclers, traders, and downstream industries.

Big Questions Shaping the Future of the Metals Ecosystem

1. How rapidly are non-ferrous metal applications evolving across energy, mobility, and technology?

2. Can India secure reliable, long-term supplies of concentrates, alumina, zinc ore, scrap, and critical minerals?

3. Will circularity, EPR policies, and integrated scrap ecosystems effectively bridge supply gaps?

4. How quickly can India scale value-added products, alloys, and downstream capabilities?

5. Which pricing benchmarks and hedging tools will best manage rising market volatility?

6. Can domestic mining expansion and new offtake partnerships align with India’s Vision 2047?

7. What strategic role will India play in the emerging global green-metal supply chain?

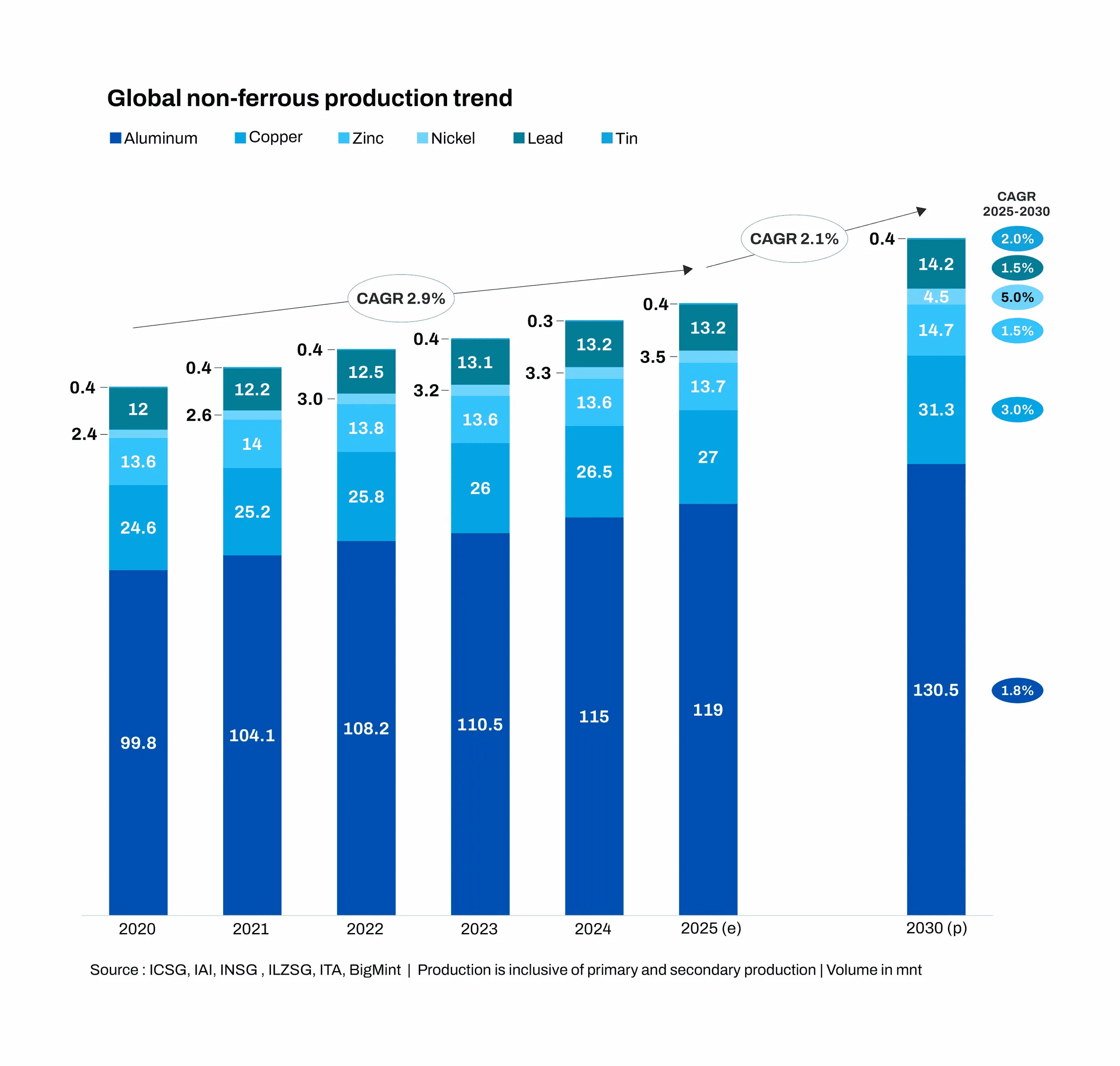

Aluminium, copper, zinc, and lead are increasingly shaping the materials landscape of the future. Their versatility and performance characteristics make them indispensable across modern industrial value chains, especially as global markets push toward high-efficiency and low-carbon solutions.

Driven by advancements in energy systems, sustainable mobility, expanding infrastructure, and emerging technologies, these non-ferrous metals are finding broader and more sophisticated applications. From electric vehicles and renewable grids to smart infrastructure and advanced manufacturing, their relevance continues to deepen.

As industries accelerate their shift toward innovation and sustainability, the strategic importance of these metals is becoming more pronounced. Their role in enabling cleaner energy, efficient transportation, and resilient infrastructure highlights their growing impact on global development.

With this transformation underway, demand for aluminium, copper, zinc, and lead is expected to rise steadily in the coming years. Their critical role in powering next-generation systems positions them as essential drivers of industrial growth and technological progress worldwide.

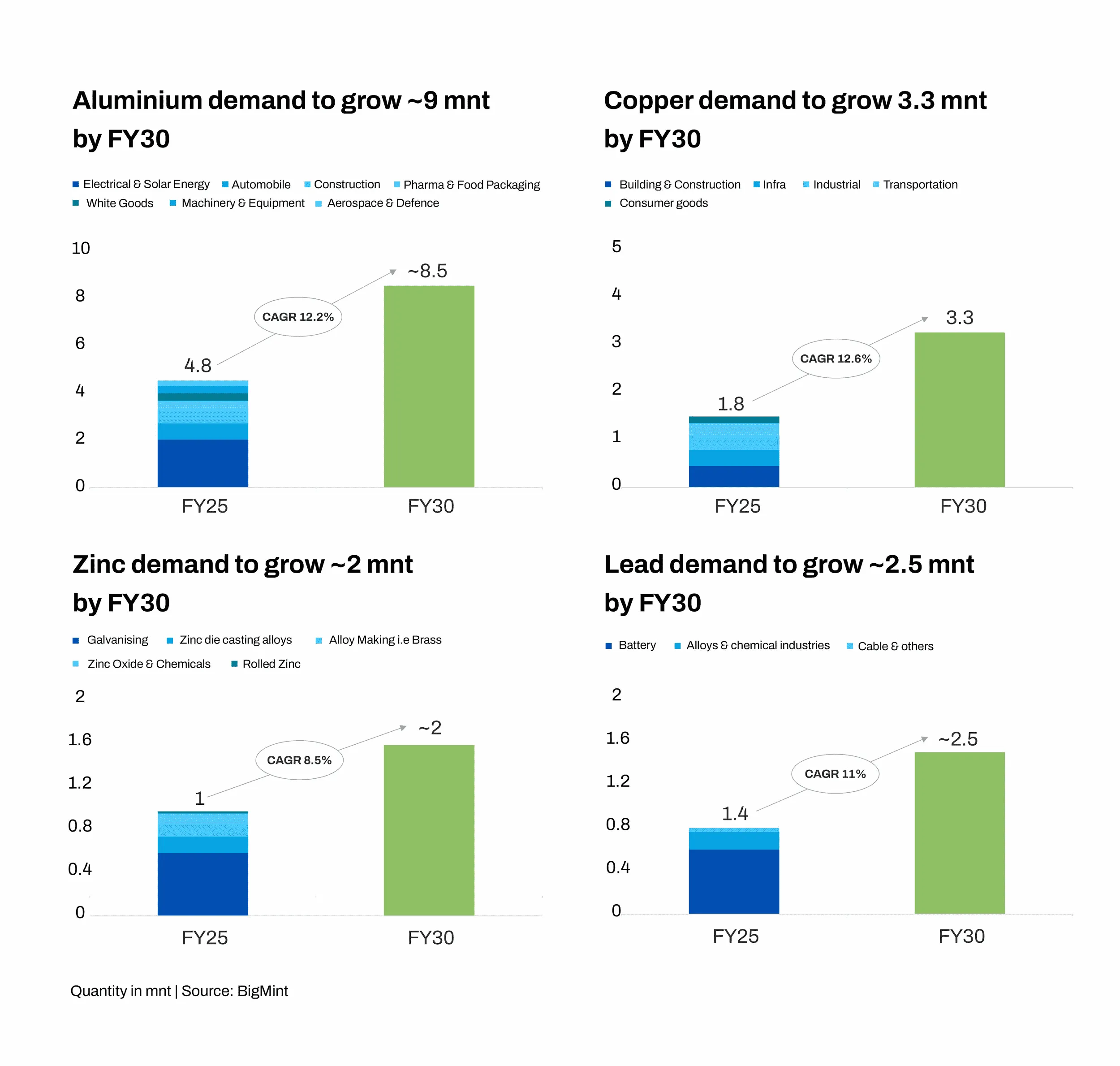

India continues to rank among the world’s fastest-growing major economies, supported by a projected GDP expansion of around 6.5% CAGR. This sustained economic momentum is creating a strong foundation for increased industrial activity, infrastructure development, and manufacturing growth.

As the economy expands, the demand for key non-ferrous metals—aluminum, copper, zinc, and lead—is set to rise substantially. These metals play a critical role across core sectors such as construction, power, transportation, and consumer goods, making them directly aligned with India’s growth trajectory.

Industry assessments indicate that consumption of these metals will grow at a healthy pace. Even on a conservative basis, demand is expected to increase by approximately 6% over the coming years. However, under more optimistic market conditions, projections suggest demand growth could climb closer to 9%.

Overall, India’s economic outlook positions the non-ferrous metals industry for a robust expansion cycle, driven by escalating domestic requirements and sustained momentum across end-use sectors.

India is entering a decisive capacity-led growth phase in the non-ferrous metals sector. Across aluminium, copper, zinc, and lead, primary output is projected to rise from around 5.8 MT in FY25 to nearly 9.5 MT by FY30. This marks one of the strongest supply-side expansions the industry has seen in the past decade.

Aluminium remains the anchor of this growth, with capacity expected to increase from 4.2 MT to 7.0 MT, driven by new smelting efficiencies and sustained investment by major producers. Copper, too, is set for a significant upswing, with capacity likely to double to 1.2 MT, restoring India’s position in the regional value chain.

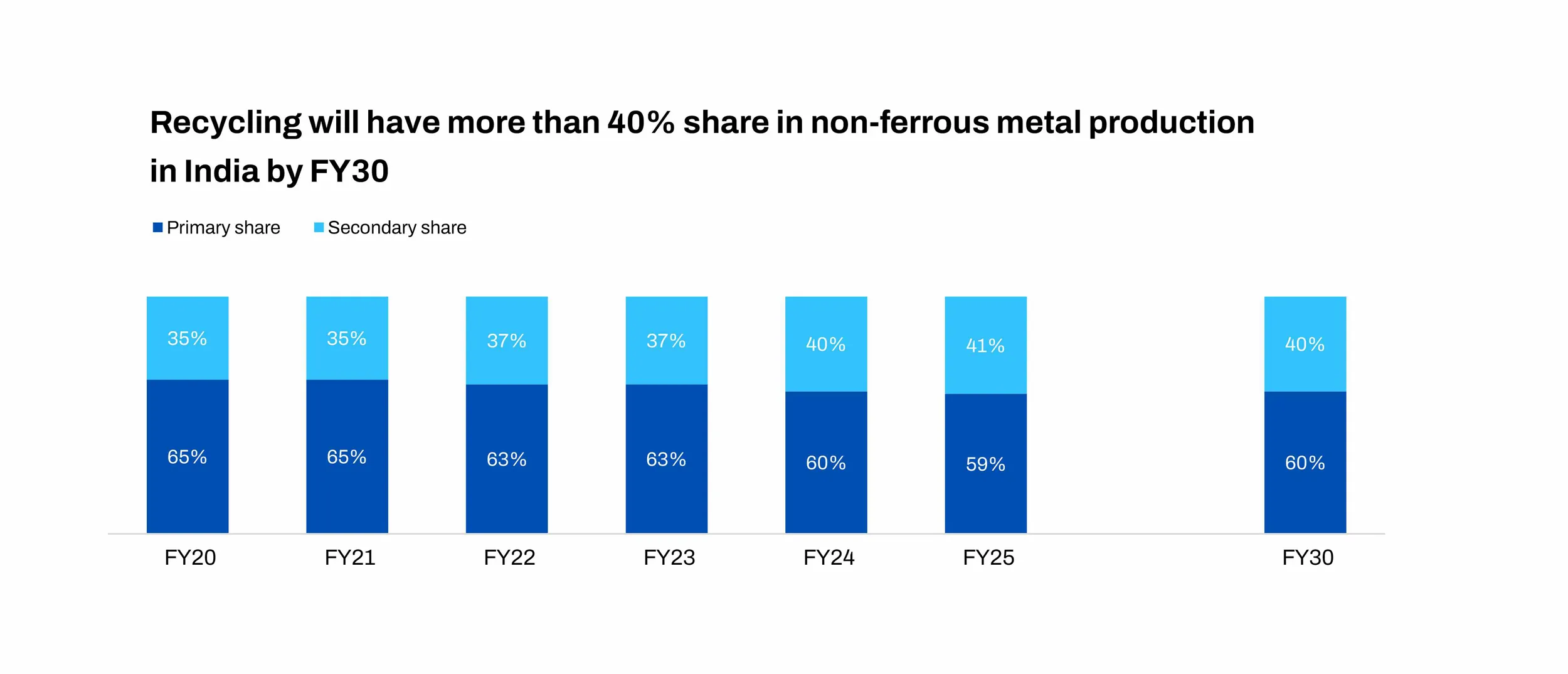

Parallel to primary expansion, the secondary non-ferrous ecosystem is strengthening. Production from recycling and scrap-based units is estimated to rise from 4.0 MT to nearly 6.2 MT by FY30, supported by improved scrap availability, formalisation of recycling networks, and a push toward circular manufacturing.

Recycled metals or metal scrap is gaining prominence as industries accelerate decarbonization efforts and align with government mandates to increase recycled content under EPR policies. The share of secondary metals in production is rising steadily, reflecting a shift toward circularity, reduced carbon footprint, and more efficient resource utilization across the aluminum, copper, zinc, and lead value chains.

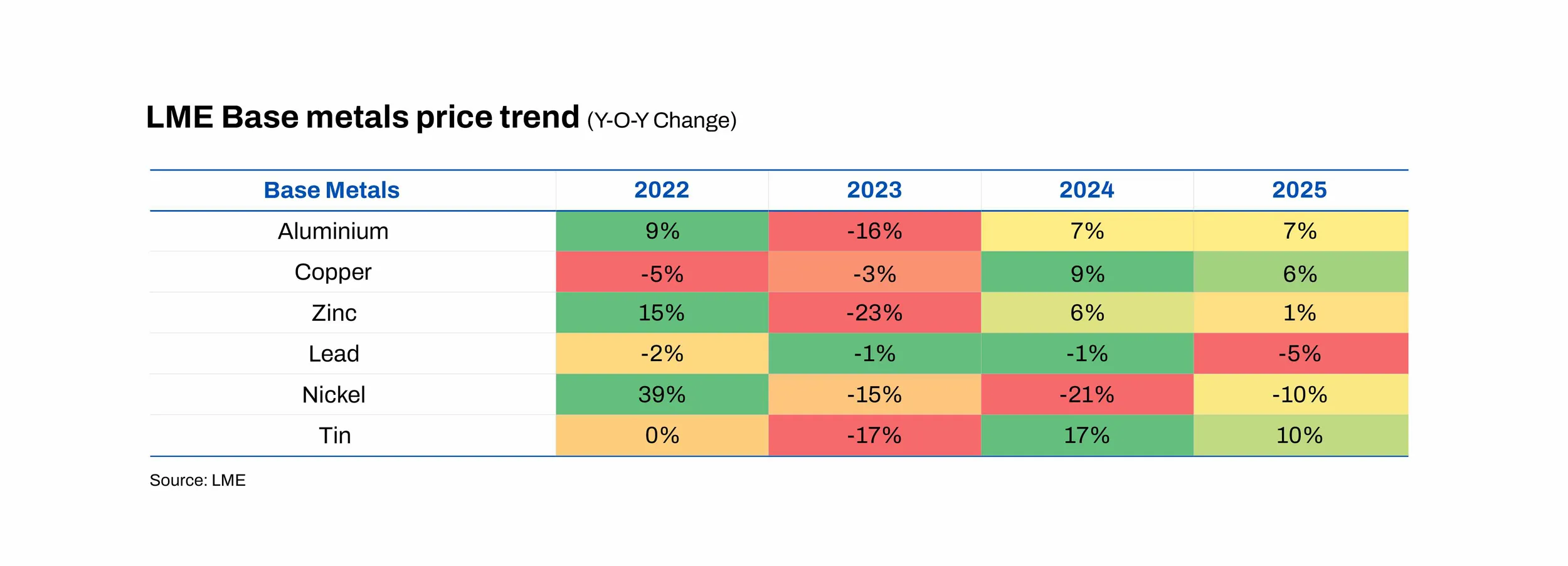

However, these metals are not immune to global uncertainties, wars, and geopolitical crises, as well as trade frictions, protectionism, tariffs, and diplomatic standoffs. Aluminum, copper, zinc, and lead have witnessed significant volatility in recent years due to shifting supply-demand dynamics, trade wars and tariffs, and the accelerating green transition. These forces continue to shape pricing trends and market stability across the non-ferrous ecosystem.

Connect with top industry leaders!

Grab the participant list now!

Global Trade & Macroeconomy

India's Vision 2047

India's Vision 2047

If you want to attend this conference and participate in the programme, then please hurry and register now!

Register Now

Ruchi Khanna

+91-9654338732

ruchi@bigmint.co

Ajeet Singh

+91-9009222344

ajeet@bigmint.co

Anamika Jain

+91-9039722000

anamika.j@bigmint.co

Puja Sharma

+91-9039466000

puja@bigmint.co